PNB Customer Alert: There is great news for the customers of Punjab National Bank. If you have not done KYC yet, do it immediately. The bank has appealed to the customers to update their KYC. The bank has tweeted and said that all customers should get KYC done by 31 August 2022. For the past several months, the bank has been appealing to its customers to update KYC (Know Your Customer). By doing KYC, the bank account of the customers will be active otherwise the customer will not be able to transfer the funds.

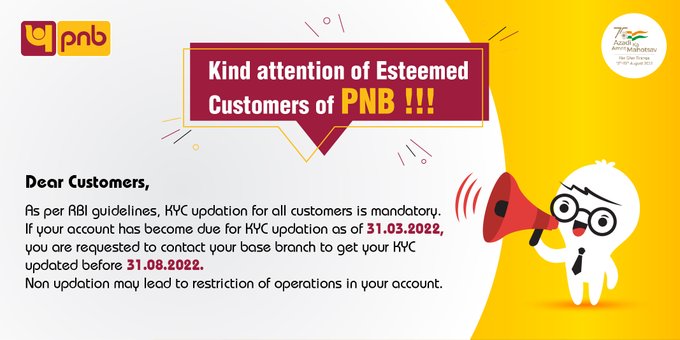

Tweet info

Punjab National Bank tweeted, “As per RBI guidelines, KYC updation is mandatory for all customers. If your account remains pending for KYC updation till 31.03.2022, you are requested to submit your KYC before 31.08.2022. Please contact your parent branch for updating the same. Failure to do the updation may result in a ban on your account transactions.

Know what is KYC?

Let us tell you that the full form of KYC is Know Your Customer. Actually, KYC is a document giving information about the customer. Under this, the customer writes all the necessary information about himself. In the field of banking, every 6 months or 1 year, the bank has to fill out the KYC form from its customers. You must include your name, bank account number, PAN card number, Aadhar card number, mobile number, and full address in this KYC form. The bank obtains all of the customer’s information in this manner. KYC is a simple process. This task is simple to complete while at home.

If you want to get it done by going to the bank then you can also do it. For this, first you go to the branch of the bank in which you have a bank account. Go there and take the KYC form from the concerned desk and fill that form and submit it by attaching all the necessary documents in it. Your KYC gets updated within 3 days of submitting the KYC form.

Read More: People connected to SBI should be careful because the bank experienced a setback in this situation.

KYC can also be done sitting at home

If you want to do KYC sitting at home then you can also do it. For this, you can e-mail your documents to the bank. Or you can also complete KYC by asking for OTP on mobile through Aadhaar. Many banks also offer KYC facilities through net banking. If your bank is also providing this facility and you do net banking then you can easily complete KYC sitting at home.

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |

Google News Google News |

Click Here |

Twitter Twitter |

Click Here |