There are other tax-saving strategies that can be investigated, from PPF to time deposits. Here, we’ll outline five such Post office schemes that can help you earn good returns and qualify for an income tax exemption under Section 80C of the Income Tax Act.

There are several possibilities available with Post office schemes

and they can offer a decent return on investment over time. The Public Provident Fund (PPF) and time deposits are just two examples of the numerous Post office schemes or tax-saving strategies available. Here, we’ll outline five such Post office schemes that can help you earn good returns and qualify for an income tax exemption under Section 80C of the Income Tax Act. Post office programmes provide a range of investing and tax-saving opportunities. People can select the plan that best meets their financial needs from a range of interest rates and investment tenures. Check about these Post office schemes.

PPF Public Provident Fund (PPF) is a long-term savings plan

that provides tax exemption under section 80C and compound interest of 7.1 per cent. To benefit from this programme, you must invest for at least 15 years. You can save up to 1.5 lakhs in taxes per year.

Sukanya Samriddhi Yojana

It comes under Post office schemes designed specifically for young girls under the age of ten. At the age of 18, the invested funds may be withdrawn, and after 21 years, the full amount may be received. With this programme, you can save up to 1.5 lakh dollars in annual taxes while also receiving an interest rate of 7.6%.

Senior Citizen Savings Scheme is one of the Post office schemes

The Senior Citizen Savings Plan, however, gives an 8% yearly interest rate. This provides up to Rs. 1.5 lakhs in tax relief. Recently, the maximum investment in this programme was raised to 30 lakhs.

Time Deposit Scheme

In addition, the post office’s time deposit programme offers a five-year investment option and a maximum tax exemption of Rs. 1.5 lakhs. This plan may be a smart choice for those wishing to reduce their tax obligations because it has a 7 per cent interest rate.

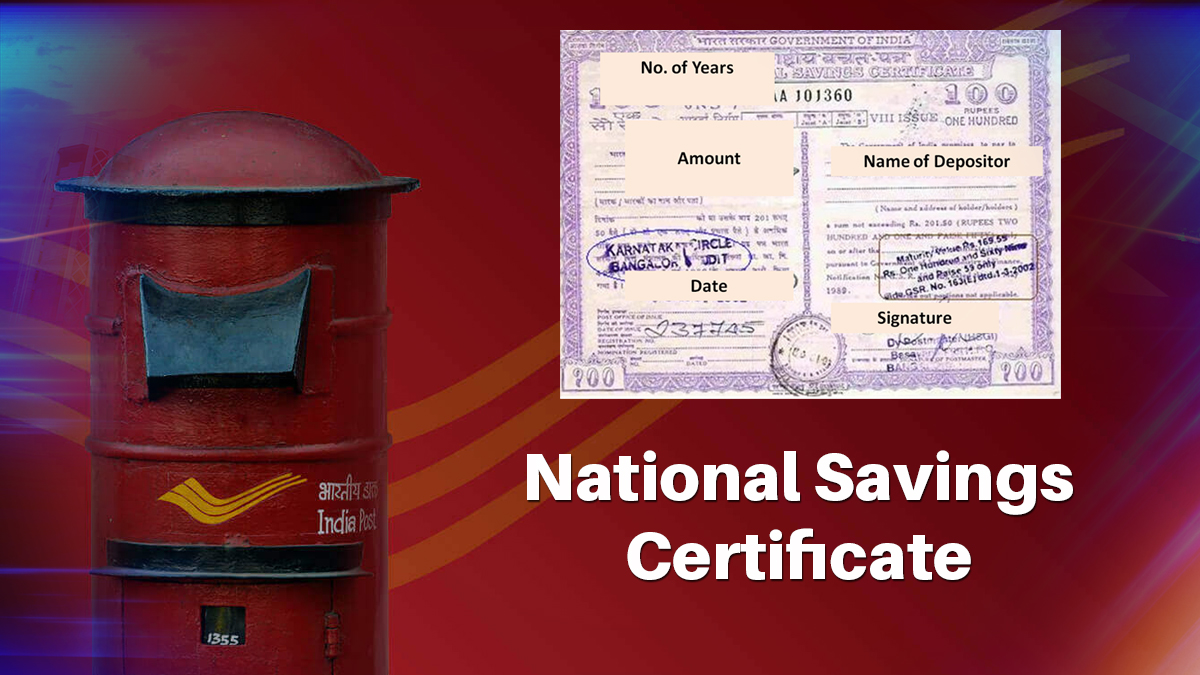

Certificate of National Savings

The National Savings Certificate (NSC), however, requires only 1000 rupees to begin. With this arrangement, there is an interest rate of 7%. Up to Rs. 1.5 lakhs in taxes may be avoided under Section 80C thanks to this programme.

Read More: Honda Shine is cheaper than Splendor with amazing mileage. See features

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |