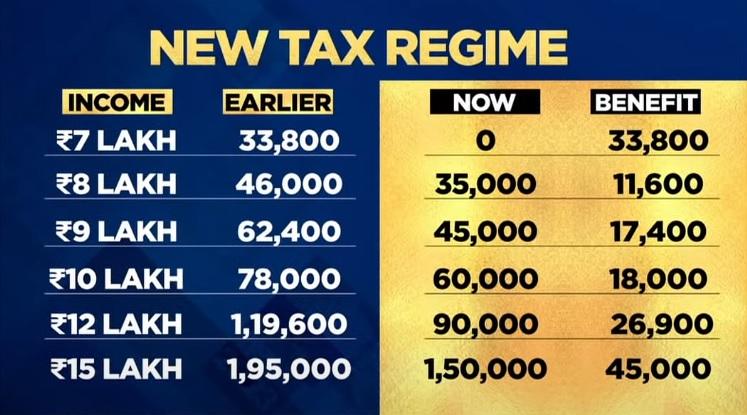

The budget for 2023 contains a number of significant announcements from the federal government. The administration has also made a number of significant pronouncements about income tax in this. The government has made significant announcements to raise the level of revenue along with this. Up to Rs 7 lakh per year, under the new tax system, no income tax will be owed as of the fiscal year 2023–24. Its previous cap was Rs 5 lakh.

Income Tax

The government changed the income tax slab at the same time as implementing the new tax system. Taxpayers who file income tax returns under the new tax system in such a case should be aware of the modified tax slabs. The Finance Minister announced various announcements in Budget 2023. Among these, the statement outlining the new tax system’s tax slabs was crucial.

Tax Slab

According to the Finance Minister, someone with an annual salary of between 0 and 3 lakh rupees won’t have to pay a lot of taxes. However, it used to have a yearly income of Rs. 2.5 lakh. On the other side, under the new tax system, anyone whose income exceeds 15 lakh rupees will be required to pay 30 percent in income tax.

Tax rates under the new tax system:

- Individuals earning between Rs 3 lakh and Rs 6 lakh annually would be subject to a 5% tax rate.

- People who earn between Rs 6 lakh and Rs 9 lakh per year must pay 10% in taxes.

- Individuals who earn between Rs 9 lakh and Rs 12 lakh per year are subject to a tax rate of 15%.

- People who earn between Rs 12 lakh and Rs 15 lakh per year must pay 20% in taxes.

- People who earn more than Rs 15 lakh per year must pay 30% in taxes.

Read More: Hyundai SUV is beating big cars! people are buying it blindly

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |