To help retail investors and others, the Reserve Bank of India today released a mobile app and portal. A smartphone app for purchasing and selling government securities was released by RBI. The RBI made several moves today to facilitate things for ordinary investors and other people. Under this, the ‘Pravah’ portal was developed for easy online application, and on the other side, a mobile app was released enabling retail investors to participate in the government securities market.

Retail investors can now use the mobile app

on their smartphones to purchase and sell government assets. In addition, the Pravah portal was introduced to make it simple for anybody or any organization to submit an online application for various regulatory approvals. The central bank said in a statement that this portal will facilitate various processes related to granting regulatory approvals by the Reserve Bank. Apart from this, RBI has taken the ‘Fintech Repository’ initiative.

Enter the OTP received on the mobile number and click on Validate.

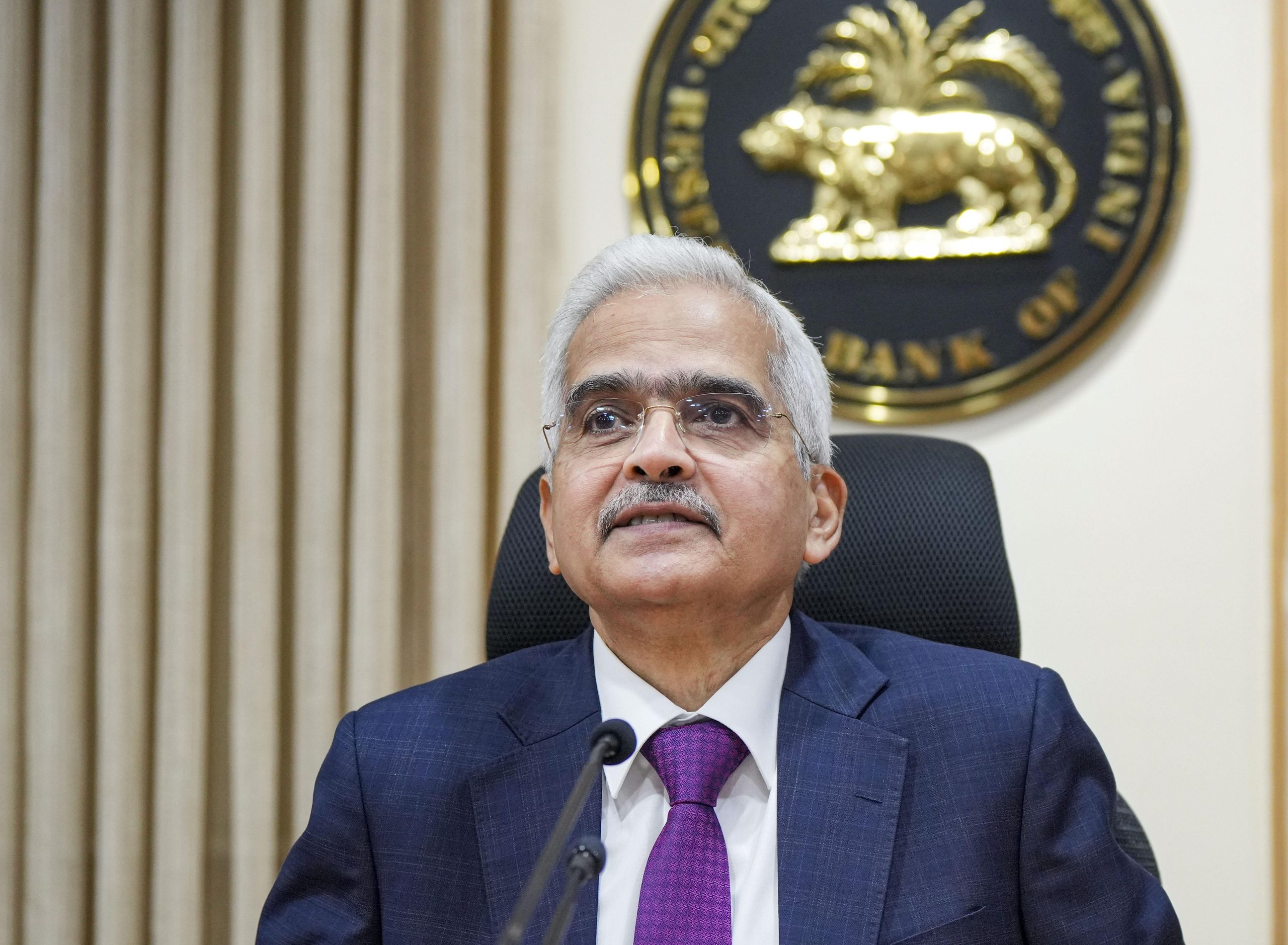

Governor Shaktikanta Das’s third initiative intends to retain data of Indian financial technology (fintech) companies. It is intended to help formulate suitable policy approaches and provide a better knowledge of the sector from a regulatory viewpoint. A safe and centralized web-based platform is called “Flow” (Platform for Regulatory Applications, Verification, and Approvals). It serves as a platform for anyone or any organization to apply for a license or regulatory permission. Or approval in matters about the Reserve Bank. In a statement outlining the portal’s functionality. RBI stated that 60 applications from several regulatory and supervisory departments may be filed online. The application’s status is visible to the relevant party via the site.

Additionally,

Additionally,

RBI can promptly send the decision on any application. It has been stated that more application forms will be supplied upon request. It was stated in the statement that retail investors can now buy and sell government assets using the ‘Retail Direct’ mobile app on their smartphones.

The mobile application

is available for download from the “App Store” for iOS users. And the “Play Store” for Android users. Retail investors can currently open retail direct government securities accounts with the Reserve Bank of India. Through the ‘Retail Direct’ platform. The Retail Direct Scheme has made this facility available. November 2021 saw the debut of the portal. It enables regular investors to buy government securities in primary auctions as well as buy and sell them in the secondary market. According to the statement, the Fintech Repository aims to obtain necessary information about financial technology units. Their activities, technology use, etc. form regulatory perspectives and appropriate policy stances.

Read More: UPSC starts recruitment for DSA and Assistant Professor, know details

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |