Tax Benefit: Should one invest in ELSS solely to receive returns, or may it help with tax savings?

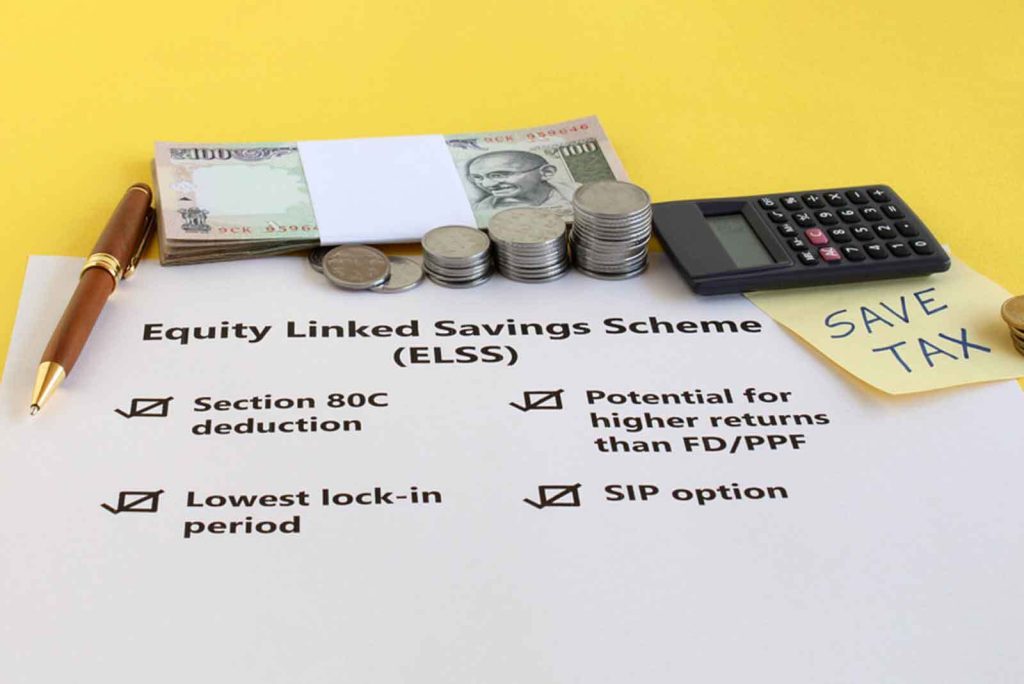

ELSS, or equity-linked savings schemes, is the new tax regime. Eighty percent of the money invested in it is in the stock market, according to Indian government regulations. People have chosen to invest in it to receive an 80C tax exemption of up to Rs 1.5 lakh. The Income Tax Bill of 2025 eliminated this clause. Because there is no provision for such an exception in the new tax regime, which has been referred to as the default tax system. Determining whether ELSS is still advantageous in such a circumstance is crucial. Does it make sense to invest in it just to earn profits, or can it also help with tax savings? Because there is not much time left until the new fiscal year begins, it is crucial to consider every facet of ELSS to plan accordingly.

Better returns are provided with ELSS.

A mutual fund is comparable to an equity-linked savings plan. It invests 80 percent of the money deposited in the stock market. Investors have received an annual return from this program of up to 14.56 percent in recent years. One could argue that this is a better return. The paid class still finds it appealing because of this. Its three-year lock-in period is another significant factor in this. This is less than any other such approach. In other words, after three years, you are free to withdraw whatever money you have put into this scheme. In addition, because it is an equity-linked program, it has excellent growth potential. ELSS has provided returns of up to 24%. Consequently, investing in it has become and continues to be a popular choice among people.

The benefit of 80C is now available at Rs 123.

There is nothing to be concerned about if your only reason for investing in ELSS is to reduce your taxes. The new Income Tax Bill eliminated the benefits of 80C, but the identical clauses under 123 are still in place. Under the new tax system, its advantages are not available. You must adhere to the previous tax system to receive tax benefits from ELSS. A Hindu Undivided Family (HUF) or person will receive an exemption under section 123 of the new Income Tax Bill on the amount paid or deposited during the tax year, up to the total of the amounts listed in Schedule 15. However, this exemption will not be greater than Rs 1.5 lakh.

Read More: Vi’s 5G Launch This Month! First City Revealed, Airtel on Alert!

| Join Our Group For All Information And Update, Also Follow me For Latest Information | |

| Facebook Page | Click Here |

| Click Here | |

| Click Here | |