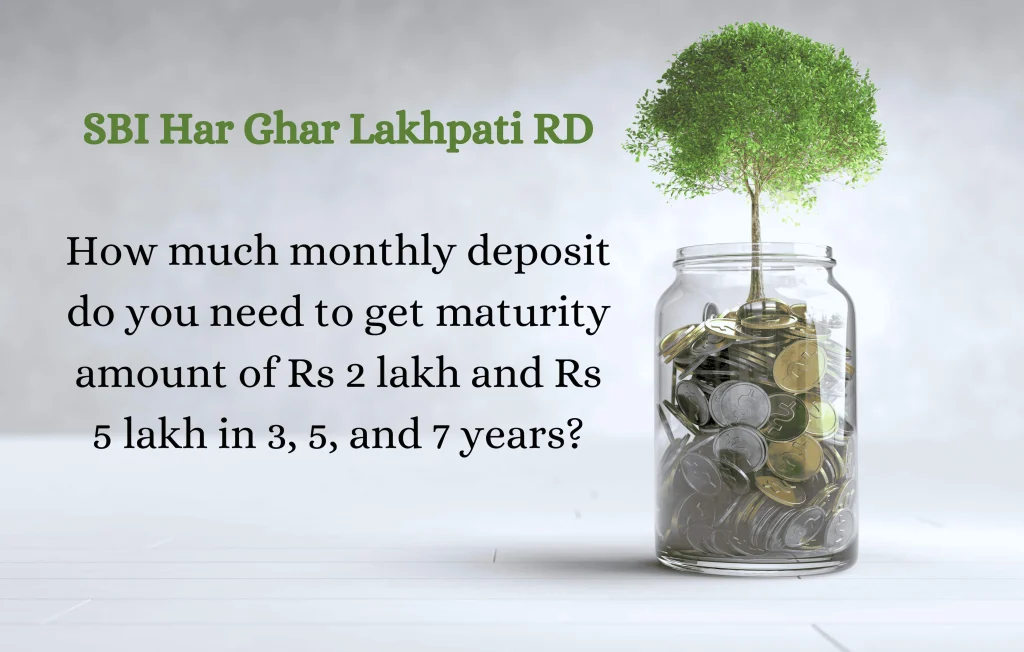

Customers who participate in SBI’s Har Ghar Lakhpati Yojana, a recurring deposit (RD) program, must deposit a set amount each month in order to get returns after a predetermined amount of time.

You can invest in the “State Bank of India” (SBI) “Har Ghar Lakhpati” program if you want to put your money in a place where you will receive a fixed return and your principal will be secure.

Customers who participate in SBI’s Har Ghar Lakhpati Yojana must deposit a certain amount each month as part of the recurring deposit (RD) program. Customers receive returns and interest after the program is finished. Interest is paid by the bank every three months.

Senior persons and common residents have varied interest rates under the Har Ghar Lakhpati Yojana. For three to four years, general citizens receive 6.75% interest; for other periods, they receive 6.50%. For three to four years, senior folks receive 7.25% interest; for other periods, they receive 7.00% interest.

Any regular person can invest in this SBI scheme. This plan has a maturity period of three to ten years. This implies that you must invest for at least three years and up to ten years.

Customers who invest as little as Rs 600 can become lakhpatis under this initiative. You will need to invest Rs 576 a month if you wish to accumulate one lakh rupees in ten years. Senior citizens receive interest at a rate of 7.00% in this case.

Investments in the Har Ghar Lakhpati plan are open to all Indian citizens. The consumer may open an account under this plan alone or in partnership.

Parents can also register an account with their child who is older than ten years old under the State Bank of India’s Har Ghar Lakhpati plan.

Read More: OCI Card: What It Is & How Many Were Cancelled in 2024

| Join Our Group For All Information And Update, Also Follow me For Latest Information | |

| Facebook Page | Click Here |

| Click Here | |

| Click Here | |