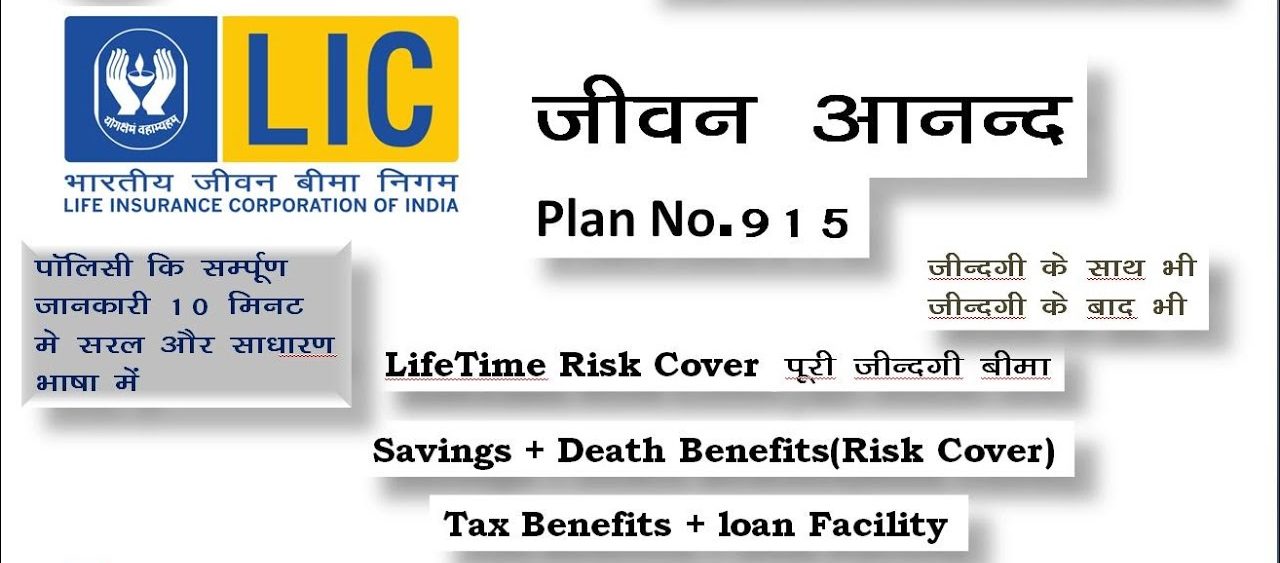

LIC continues to offer a variety of programs to its clients. Customers can choose a LIC policy based on their preferences. We are going to tell you about one of these schemes known as the Jeevan Anand Policy. When you have invested in it, you will earn a high return and the maturity benefit is also offered. It is a premium-term policy. We’ll show you exactly how to profit from it.

Make an investment of just 45 rupees every day to build a number of lakhs.

If you are looking to acquire an amount that is huge, possibly upwards of Rs 25 lakh then you must put aside 45 rupees every day from this month. It will be 1358 rupees, and when it is time to mature you could obtain a large amount. You must make an investment in the longer term.

Who is eligible to invest?

Anyone who is 18 or more is eligible to invest in this scheme. If you make investments for a continuous period of 15 years, you will also receive a bonus.

You can put money into the bank

you can make a deposit in this scheme for a period of 35 years. Upon maturity after 35 years, you receive 25 lakh rupees.

Documents for Jeevan Anand policy Jeevan Anand policy

-Aadhar card

-PAN card

-Bank Account

-mobile number

This benefit will be provided within the policies.

This plan, there are various advantages. The ability to raise the amount that you are insured in the event of an accident, death, or serious illness. the investor may also raise the amount he has guaranteed. LIC provides 125 percent in cash upon the death of an investor.

Read More: Modi government is providing greater benefits than FDs On several schemes

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |

Google News Google News |

Click Here |