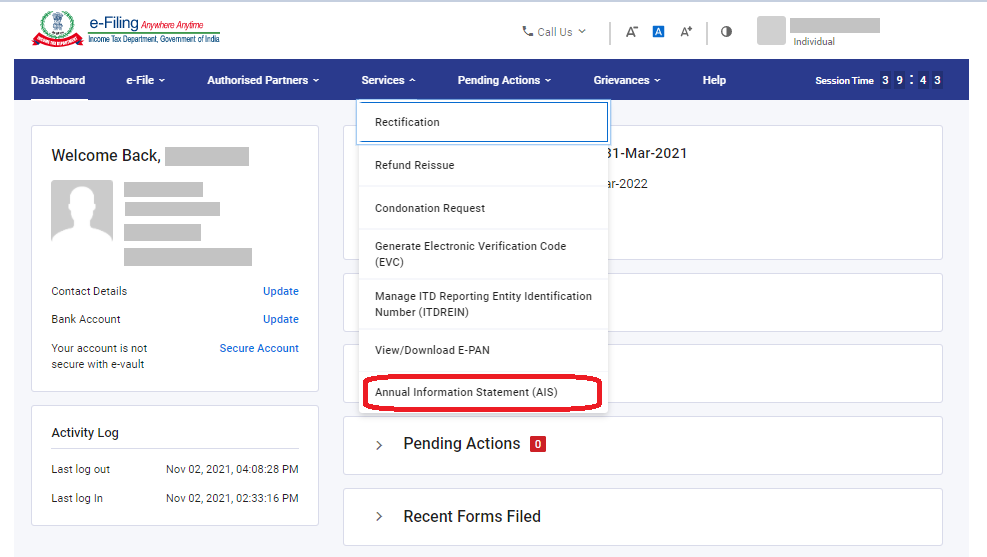

The country’s Income Tax Department continues to release information regarding the ongoing deadline for filing income tax returns. The annual information statement now contains an additional aspect, known as the Annual Information Statement (AIS), according to the Income Tax Department. Taxpayers will be able to view the progress of the information verification process using this. Central Board of Direct Taxes: According to a statement from the Central Board of Direct Taxes (CBDT), the Income Tax Department has launched a new system in AIS that displays the progress of the information confirmation procedure.

Which recently introduced system?

Which recently introduced system?

The preparation of AIS is based on financial data gathered from various data sources. It offers information about a lot of financial transactions of taxpayers which may have tax implications. Taxpayers have been given the facility to give feedback on each transaction shown in the AIS system. This feedback helps the taxpayer to comment on the accuracy of the information received from the source of such information. In case of incorrect reporting, it is automatically routed to the source for verification.

Data can be updated.

Data can be updated.

The CBDT statement states that this will show whether the source has accepted, rejected, or partially processed the taxpayer’s response. If the information is accepted in part or all, a correction statement from the source must be filed to correct the information.

The Income Tax Department wants to make things more transparent.

The Income Tax Department wants to make things more transparent.

According to CBDT, by providing taxpayers with access to such information in AIS, the new system is anticipated to enhance transparency. The Income Tax Department is taking this further step to improve taxpayer services and make compliance easier.

Read More: BMW launched a new bike which created a stir! know the features

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |