The MCLR has recently been boosted by many of the country’s major banks. If you have a home loan, vehicle loan, or personal loan, your interest rate will almost certainly rise if the MCLR rises. Your EMI will be affected as a result of this. Find out which banks have raised their interest rates.

SBI

On Monday, the State Bank of India (SBI) hiked the MCLR by 10 basis points (0.10 percent). Following this, all bank loans became more expensive.

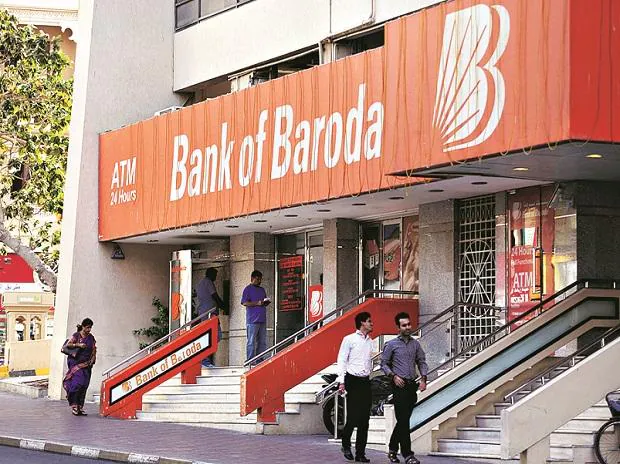

Bank of Baroda

On April 12, the Bank of Baroda (BoB) upped the interest rate by 0.05 percent. Your loan’s EMI will be greater as a result of this.

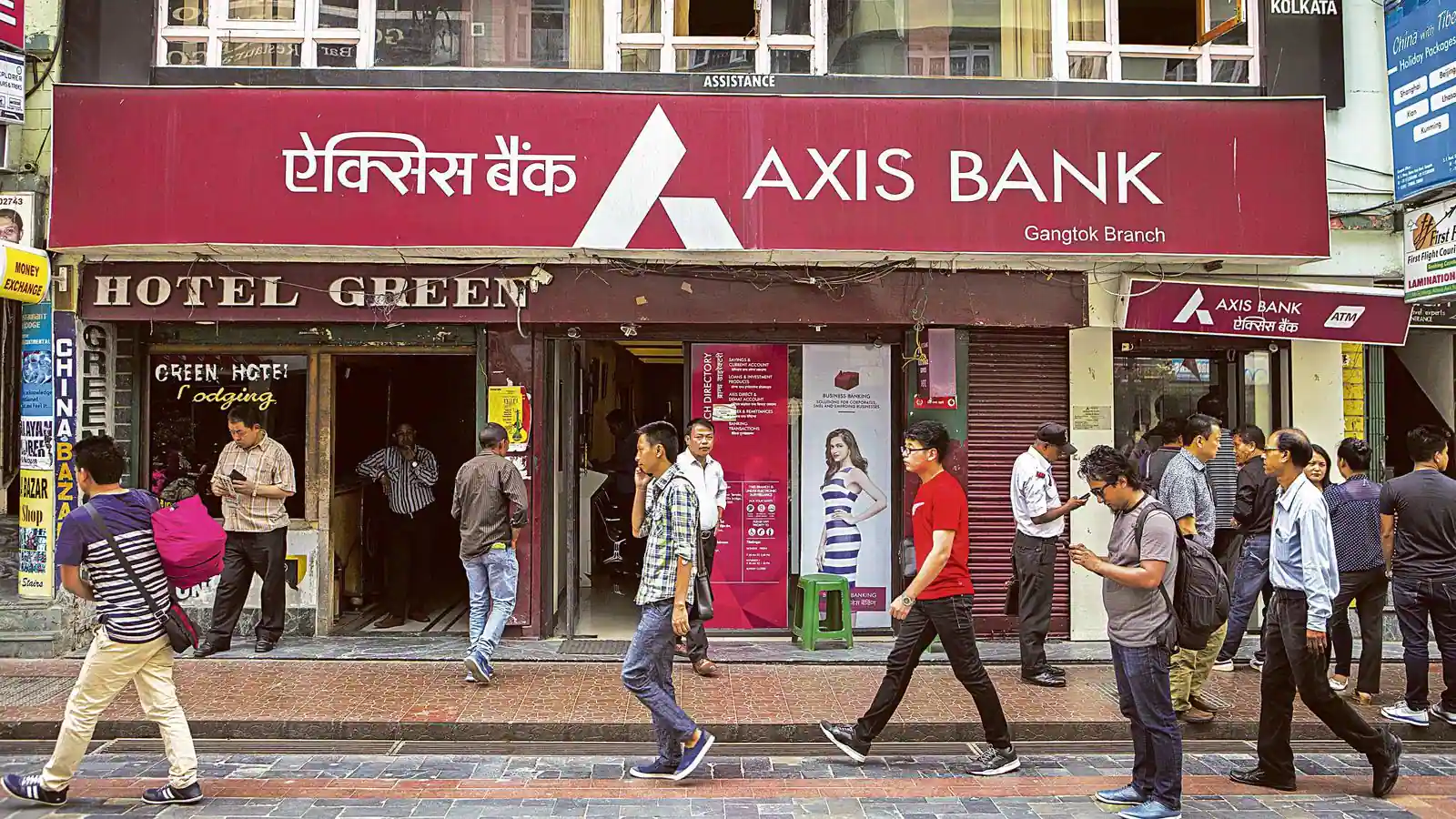

Axis Bank

Axis Bank has similarly increased the cost of its loan. The MCLR has been raised by 0.05 percent by the bank. The higher interest rates went into effect on April 18th.

Kotak Mahindra Bank

Customers were likewise surprised when Kotak Mahindra Bank raised the MCLR. The bank’s rates were raised on April 16, 2022, and are already in effect.

Know what is MCLR?

The MCLR is a benchmark that determines interest rates based on a bank’s internal expenses and charges.