The Atal Pension Yojana has undergone significant adjustments from the government (APY). A person who begins paying income tax on October 1, 2022, will not be qualified to participate in this program, according to a gazette announcement released by the Finance Ministry. The Modi administration introduced this program in 2015, with a primary focus on the unorganized sector’s workforce.

According to the Finance Ministry, if a subscriber joins this program on or after October 1 and is later discovered to be an income tax payer, his APY account will be terminated, and the subscriber will get the pension money that was deposited up until that point. APY provides financial security for those whose financial future is uncertain.

Know about the scheme

A monthly pension of Rs 1,000 to Rs 5,000 is available under the Atal Pension Yojana upon reaching the age of 60. Investments in the program are open to everyone between the ages of 18 and 40. Alternatively said, you must commit at least 20 years to it.

To get a pension of 1 to 5 thousand rupees per month, the subscriber must pay 42 to 210 rupees each month. This will happen when you enroll in the plan at the age of 18.

A participant who joins the plan at the age of 40 will be required to pay a monthly contribution of between Rs 291 and Rs 1,454. The bigger the subscriber’s contribution, the greater the pension he will receive after retirement.

After the death of the subscriber, the nominee will be given the pension money that has accrued up to the age of 60. The subscriber’s spouse will continue to receive the same pension.

If a subscriber passes away too soon (before the age of 60), their spouse may continue making contributions for the remaining time. In this program, the government guarantees a minimum pension.

Under

Investors can participate in this program by making monthly, quarterly, or semi-annual (6-month) investments. The contribution will be auto-debited, which means that the money will be taken out of your account and added to your pension account without any more action on your part.

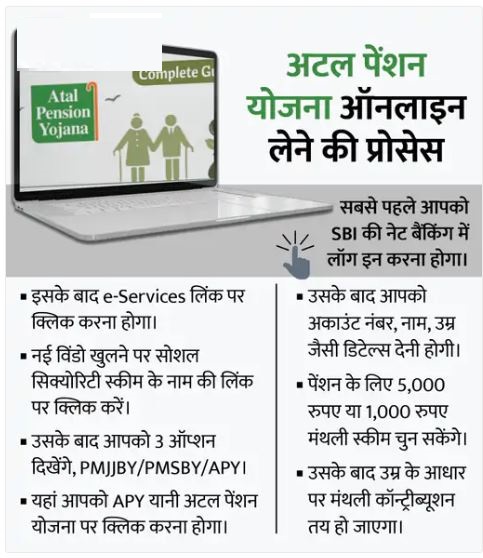

Accounts can be opened online

Online account opening is available, and more than 4 crore people have signed up for this program. More than 99 lakh accounts were opened under the Atal Pension Yojana in the most recent fiscal year, or FY2021-22, according to the Pension Fund Regulator (PFRDA). Every nationalized bank offers the APY program. Here, we describe how to open an Atal Pension Scheme online account with the State Bank of India.

You can also open

Additionally, you can open an account simply by traveling to any bank and opening one there. You must complete the Atal Pension Yojana application and send it to the bank branch along with the necessary paperwork. You will receive a confirmation message after the application has been accepted.

Atal Pension Yojana-related queries and responses.

1. I don’t have a savings account; can I still start an APY account?

No, a savings bank account is required for this scheme.

2. What Determines the Monthly Contribution Date?

The first investment date is used to make the decision.

3. Is a nominee required of the subscribers?

Yes, having a nominee is required.

4. How many Atal Pension Yojana accounts can be opened?

Atal Pension Yojana accounts can only be opened in sets of one.

5. What happens if there isn’t enough money in the account to cover the monthly payment?

If you don’t have enough money in your account to cover your monthly contribution, you’ll be

penalized.

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |

Google News Google News |

Click Here |

Twitter Twitter |

Click Here |