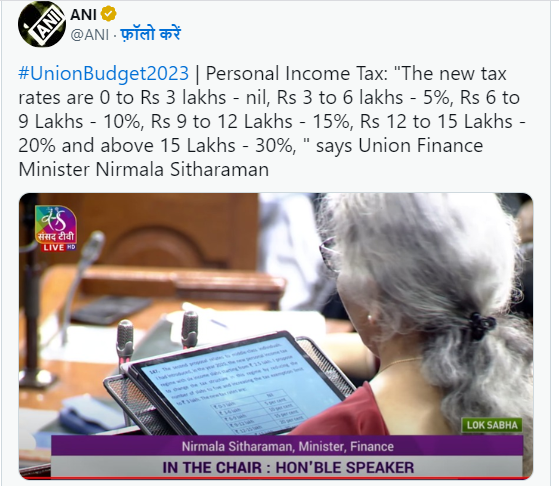

Income Tax Slab Change: Finance Minister Nirmala Sitharaman has made a big announcement regarding income tax slab rates. If you also pay tax, now the Finance Minister has made a big change in the tax slab. The government has abolished the old tax slabs. From now on you will have to pay tax under the new slab.

Let’s see the new tax slabs-

>> 0 to 3 lakh – 0 percent

>> 3 to 6 lakh – 5 percent

>. 6 to 9 lakh – 10% tax

>> 9 to 12 lakh – 15% tax

>> 12 to 15 lakh – 20%

>> above 15 lakh – 30%

Exemption increased in the new tax regime

Finance Minister Nirmala Sitharaman has made several announcements for the benefit of taxpayers. In this, regarding income tax, the Finance Minister announced that under the new tax system, the exemption has been increased on income up to Rs 7 lakh. Earlier this exemption was available up to Rs 5 lakh. Along with this, the income tax slab has also been increased. Now there will be no tax up to Rs 7 lakh. Salaried people will get benefits.

Read More: Budget 2023: If you use PAN card, a big update has come, the Finance Minister himself said such a big thing in the budget speech

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |

Google News Google News |

Click Here |

Twitter Twitter |

Click Here |