The optional exemption-free tax system, which is offered under section 115BAC of the IT Act, was modified as part of the Budget 2023–24, which was presented on February 1, to encourage salaried-class taxpayers to transition to the new tax regime. For a single taxpayer, the revised concessional tax scheme is now the default. The current fiscal year’s Tax Deducted at Source (TDS) deduction by employers was clarified by the Central Board of Direct Taxes (CBDT) on Wednesday.

The optional exemption-free tax system,

which is offered under section 115BAC of the I-T Act, was modified as part of the Budget 2023–24, which was presented on February 1, to encourage salaried-class taxpayers to transition to the new tax regime. For a single taxpayer, the revised concessional tax scheme is now the default. The current fiscal year’s Tax Deducted at Source (TDS) deduction by employers was clarified by the Central Board of Direct Taxes (CBDT) on Wednesday.

According to the CBDT, “a deductor, being an employer,

shall seek information from each of its employees regarding their intended tax regime and each such employee shall intimate the same to the deductor, being his employer regarding his intended tax regime for each year, and upon intimation, the deductor shall compute his total income, and the deductor shall deduct tax at source thereon in accordance with the option exercised.” It was added that if no notification is given by the employee, it would be assumed that they are still subject to the new tax regime by default.

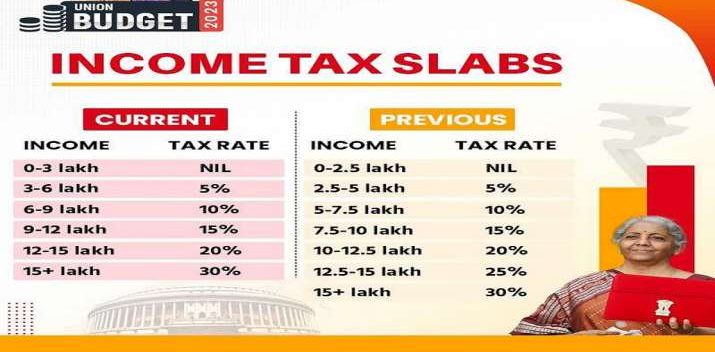

For people with an annual income of up to 7 lakh,

there will be no tax under the new tax system as revealed in the Budget. The basic exemption level was raised to 3 lakh and a standard deduction of 50,000 was allowed. Income between 3 and 6 lakh would be taxed at a rate of 5%; 6 to 9 lakh at a rate of 10%; 9 to 12 lakh at a rate of 15%; 12 to 15 lakh at a rate of 20%; and 15 lakhs and above at a rate of 30%.

The baseline exemption level under the previous tax code,

which provides for exemptions and deductions, is 2.5 lakh rupees. Moreover, anyone with an annual income of 5 lakh rupees is exempt from paying taxes. A 5% tax is applied to income between 2.5 lakh and 5 lakh, while a 20% tax is applied to income between 5 lakh and 10 lakh. Taxes on income beyond Rs 10 lakh are levied at 30%.

The CBDT stated that it had received complaints

about the tax to be withheld at source (TDS) on a person’s pay income. Under Section 192 of the Act because the deductor, an employer, would not be aware of the person. As an employee, would choose to forego taxation under Section 115BAC of the Act.

Read More: RBI broke good news! repo rate remains unchanged giving relief to bank customers

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |