People fill out Income Tax Returns (ITR) each year. If ITR is correctly completed, people also receive an exemption. Taxpayers make a significant contribution to the growth of the national economy. People use a variety of strategies to reduce their income tax. The government operates a number of tax deduction programs.

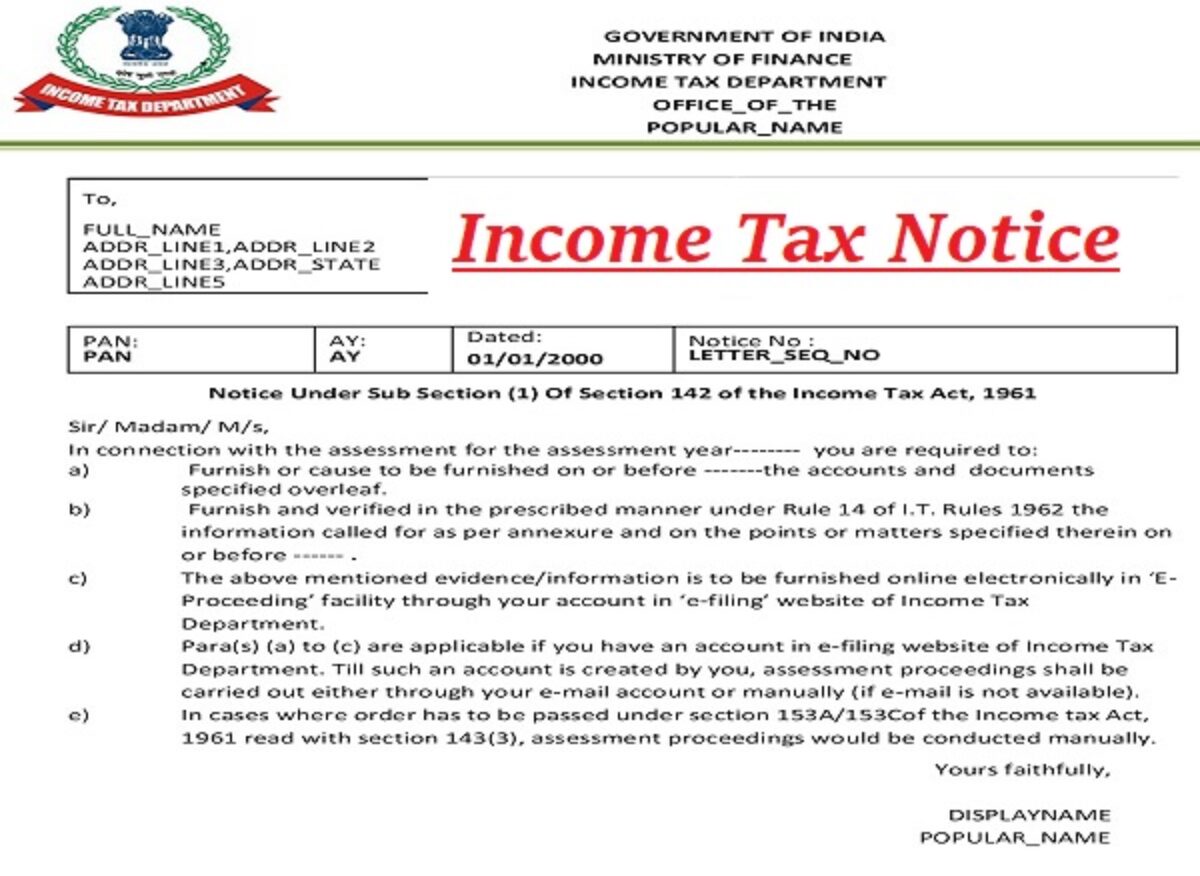

Taxpayers are required to disclose all of their

investments when completing their ITRs. However, many people provide inaccurate information in ITRs, which causes complications for them. Those taxpayers who provide inaccurate information may receive notices from Income Tax under several Acts. Tax returns are examined in two different ways. Initially required, then manual. But if you bear a few things in mind, you can avoid it.

Missing ITR filing

Additionally, notices are sent to taxpayers who do not file ITR by the Income Tax Department. People entering the income tax bracket must fill out an ITR. Even if you are an Indian citizen and have assets overseas, you are still required to file an ITR. If not filled out, a tax note may be sent home.

Errors in TDS

Even when filling out TDS, mistakes are frequently made. Notice can arrive at home even if there is a discrepancy between TDS deposited and TDS deposited. Therefore, before submitting an ITR, you must be aware of the TDS deduction amount.

Unreported income

You are required to disclose your annual income on the ITR. In addition, the investment must be disclosed. Income tax officials may also send you a notice if you receive income from investments but fail to disclose it. You can obtain the bank’s interest statement and include it in the ITR to prevent this. Along with this, you must disclose any additional sources of income you may have.

Error in ITR

In a rush, people frequently fill out ITR forms incorrectly and leave out critical information. Notice may also arrive at home in such a case.

High-value exchanges

You may also receive notice if you carry out a significant transaction that differs from your typical transaction. For instance, the Income Tax Department may look into it or inquire about the source of income if your annual income is Rs 5 lakh and Rs 12 lakh is put into your account.

Read More: RBI makes Rs 2000 out of circulation! know here how to exchange the notes

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |