Nav-Business Credit Scores is a pioneering brand that is revolutionizing the way small businesses access and understand their creditworthiness. With a mission to empower small enterprises and entrepreneurs, Nav-Business Credit Scores has become a trusted platform for businesses seeking to navigate the world of credit and financing.

One of the key advantages of Nav-Business Credit Scores

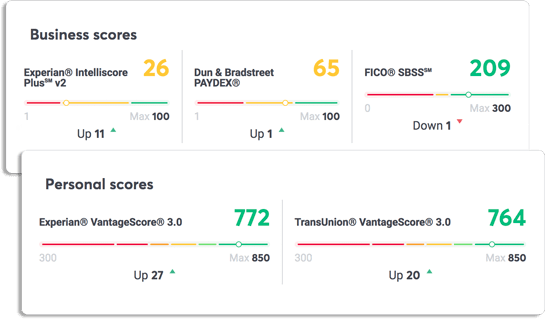

is its comprehensive and accurate credit scoring system. The brand provides small businesses with access to their credit scores from major credit bureaus, offering a clear picture of their financial health and creditworthiness. This valuable insight allows businesses to identify areas for improvement and take proactive steps to strengthen their credit profiles. Nav-Business Credit Scores’ dedication to education and guidance sets it apart from traditional credit reporting services. The brand equips small businesses with educational resources and personalized advice to help them understand and improve their credit scores. By demystifying the complexities of credit, it empowers entrepreneurs to make informed decisions and access better financing options.

Moreover, the Nav-Business Credit Scores platform

simplifies the process of accessing credit and financing for small businesses. The brand partners with a network of lenders, providing businesses with tailored financing solutions based on their credit profiles. This strategic matchmaking enables businesses to secure funding more efficiently and at competitive terms. This brand’s commitment to security and data protection further enhances its reputation as a reliable brand. The platform employs stringent security measures to safeguard sensitive business information and ensure a safe and secure experience for its users.

In conclusion,

it stands as a trailblazing brand that unlocks opportunities for small businesses. With its comprehensive credit scoring system, educational resources, strategic lender partnerships, and dedication to security. It empowers entrepreneurs to make confident financial decisions. And access the credit and financing they need to grow and thrive. Whether it’s securing a loan, negotiating better terms, or building a stronger credit foundation. It is a valuable ally for small businesses on their path to success.