RBI has made a significant choice. Banks and non-banking financial corporations (NBFCs) view personal loans as risky, thus the Reserve Bank of India has now tightened regulations even more. There has been a 25% increase in the risk weighting. Some clients, nevertheless, will not be covered by the updated regulations. These consist of loans for a house, schooling, and cars. This kind of loan will not be subject to the new regulations.

Aside from that,

debts secured by gold and gold jewelry will not be subject to this law. For these loans, there will be a 100 percent risk weighting. We would like to inform you that banks will need to set aside a larger sum for personal loans that are deemed unsecured due to high-risk weightage. Put otherwise, a high-risk weighting restricts the amount that banks can lend.

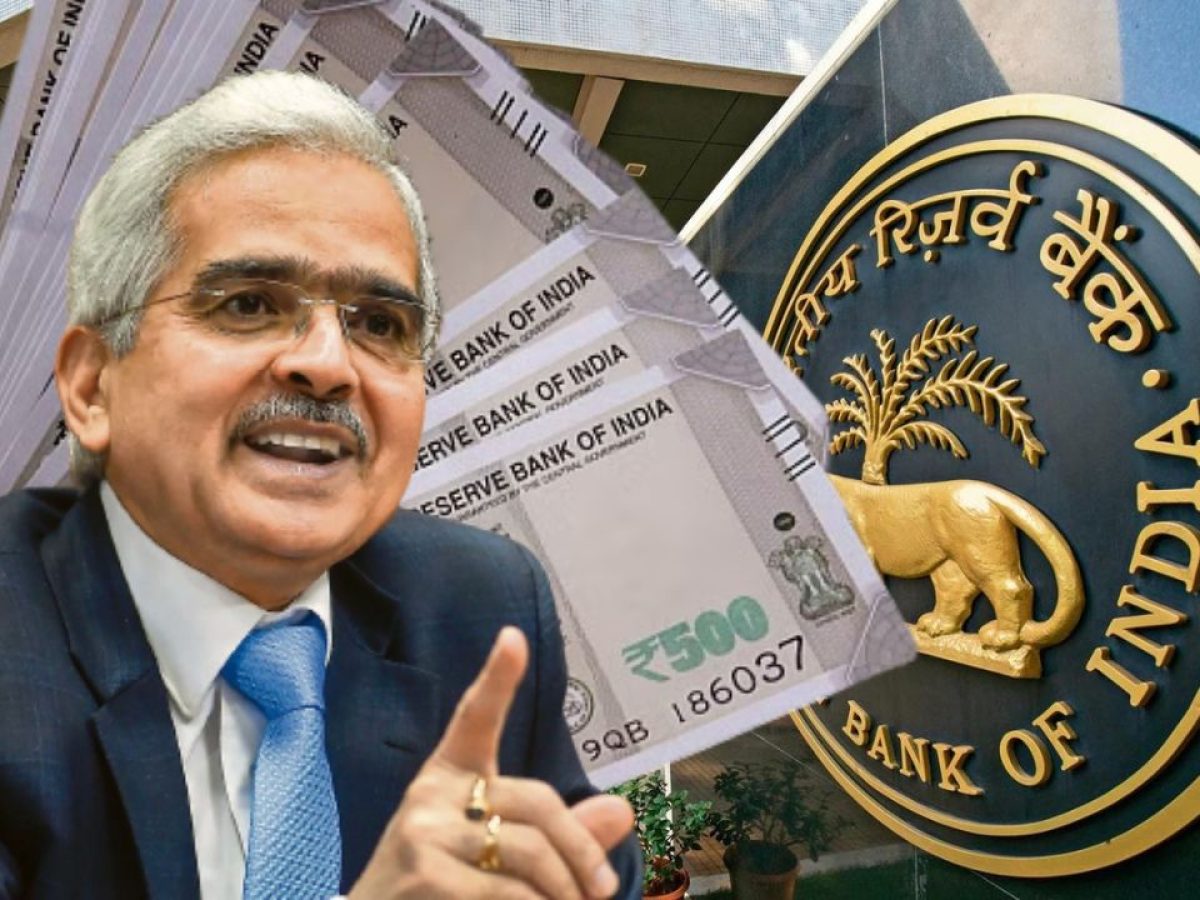

Shaktikanta Das provided details.

Governor of the Reserve Bank Shaktikanta Das has discussed a possible hike in interest rates for certain consumer loans. In order to protect themselves, he counseled banks and non-banking financial institutions to bolster their internal monitoring frameworks, manage growing risks, and implement the necessary security measures. When Das met with the MDs and CEOs of big banks and NBFCs in July and August, respectively, he also brought up the rapid rise in consumer credit and the NBFCs’ growing reliance on bank loans.

Information was provided by RBI in the notice.

In a notification, the RBI stated that it has decided to raise the risk weight for consumer loans from commercial banks, including personal loans, both new and outstanding, based on a review. This results in a 25 percent to 125 percent rise in the risk weight. Home loans, school loans, auto loans, and loans based on gold and gold jewelry are not included in this category, though. Additionally, the risk weight on loan receipts for banks and non-bank financial companies (NBFCs) has been raised by the central bank by 25% to 15% and 12%, respectively.

Read More: These six cars are the safest for kids! see the full list here

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |