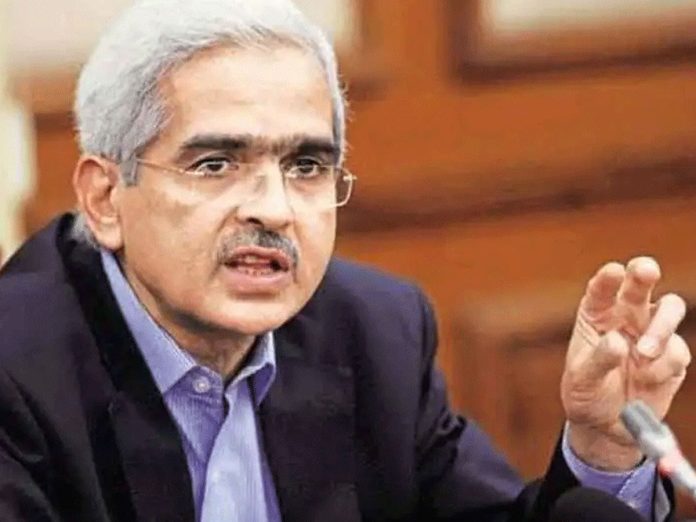

The monetary policy review was released by Governor Shaktikanta Das of the Reserve Bank of India (RBI). The repo rate has remained at 6.5 percent and there has been no alteration to the main policy rate this time either. Customers who take out loans will profit if the repo rate stays at its previous level. The interest rate on personal, vehicle, and house loans will stay the same. For the sixth time in a row, the repo rate has remained unchanged. Das stated that there was a unanimous decision made at the MPC meeting to keep the repo rate unchanged. In February 2023, the central bank raised the repo rate to 6.5 percent.

Governor Das of the Central Bank stated

that the nation’s economy is demonstrating resilience in the face of global uncertainties when announcing the review of monetary policy. While economic growth is rising, inflation is falling at the same time. To reduce inflation and boost economic expansion, the repo rate has remained unchanged. He declared that the rate of growth is quickening and exceeding most analysts’ projections.

The rate of global growth is anticipated to stay constant.

In addition, the RBI has maintained the 6.75 percent bank rate and MSF (Marginal Standing Facility Rate). The governor of the Reserve Bank of India stated that 2024 is projected to see steady global growth. According to him, MPC is dedicated to achieving a four percent inflation rate. Constant labor is being done on this. Das expressed hope that the pace of industrial activity will continue in 2024-25.

Let us inform you that the inflation rate

reached a record high of 7.44 percent in July of 2023. Following this, a decrease was observed, reaching 5.69 percent in December 2023. The Reserve Bank’s goal is to maintain an inflation rate between four and six percent. The repo rate is the interest rate at which the RBI lends money to banks. Banks will pay higher interest rates for loans from the RBI if the repo rate rises. This will directly affect your EMI by raising the interest rates on personal, auto, and house loans, among other loans.

Read More: DSSSB Admit Card 2024 released! recruitment exam on 12th Feb

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |