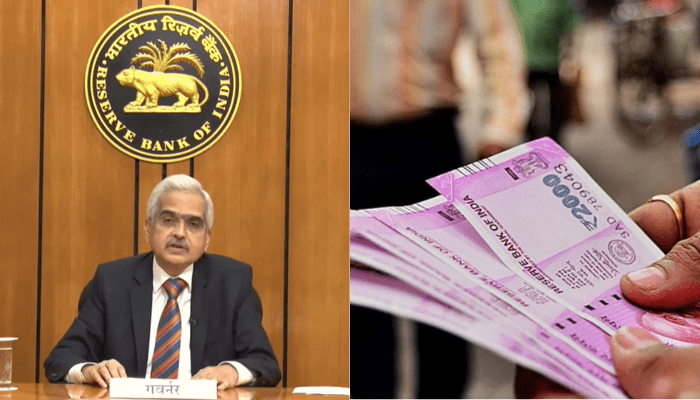

The RBI Monetary Policy Committee (RPC) meeting will begin today. This is the inaugural meeting for the 2024–2025 fiscal year. This meeting is scheduled to begin today, April 3, and go through April 5. On April 5, the choices made at this meeting will be made public. Regarding this meeting, a lot of people are wondering. The repo rates are at 6.5 percent.

We would like to inform you that the repo rates

have remained unchanged for the past six times, and there is no expectation that they will alter this time either. Analysts predict that this time around the repo rates may remain stable. The RBI may lower repo rates in the third quarter of the 2025 fiscal year, according to SBI experts. Chief Economic Advisor Soumya Kanti Ghosh reportedly stated that the RBI will not alter its position for the time being, per a study report. RBI banks are only required to offer loans at repo rates.

A few nations began lowering their interest rates.

Regarding other nations, the first significant economy to lower policy rates is Switzerland. After eight years, Japan has likewise reversed the declining trend in interest rates. The repo rate, or interest rate at which the Reserve Bank of India (RBI), the nation’s central bank, grants loans to commercial banks. On this basis, the EMI of the loan takers is decided. When repo rates increase, banks increase loan interest rates. At the same time, when repo rates decrease, banks reduce loan interest rates.

The repo rate fluctuates; why?

The repo rate fluctuates; why?

The Reserve Bank manages inflation by raising and lowering interest rates. This is inflation, which global central banks are constantly raising or lowering interest rates to combat.

This fiscal year, when will the monetary policy meeting take place?

>> April 3-5, 2024

>> June 5-7, 2024

>> August 6-8, 2024

>> October 7-9, 2024

>> December 4-6, 2024

>> February 5-7, 2025

Read More: First Solar Eclipse of the 2024 will be held on this day, know the details

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |