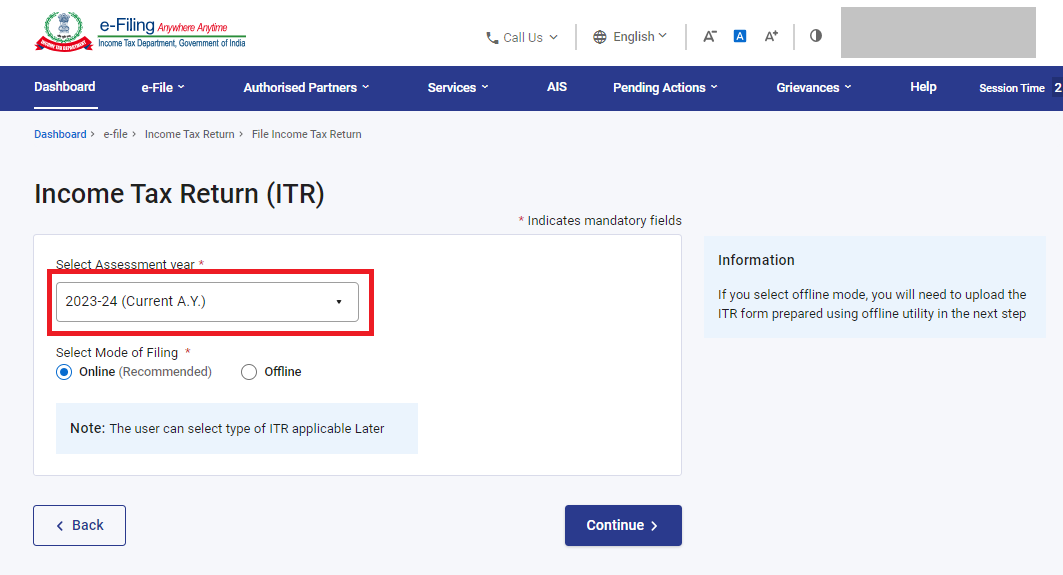

The ITR filing season is well underway. Thus far, almost 13 lakh income tax returns have been submitted. Of them, 8.17 lakh ITRs have already been processed by the Income Tax Department. Similar to every ITR filing season, taxpayers are talking about Form-16 this time around as well.

Form-16 will be accessible by June 15th.

Form-16 is intended for individuals filing income taxes who are employed by a firm. The Form-16 is provided to you by your employer. Every employee typically receives Form-16 by June 15th of each year. This time, a lot of businesses have already given their employees Form-16, and a lot of businesses’ employees are waiting to get Form-16 to file returns. Form-16 details the employee’s pay from the employer as well as any deductions and exemptions he has requested. This form additionally provides information regarding TDS, or tax withheld at source, which is withheld from employee salaries by the employer. Every business is required by Section 203 of the Income Tax Act to provide Form-16 to its workers.

Form-16 is divided into two halves.

Form-16 is divided into two halves. The name, address, PAN, and TAN number of the employer are included in the first section, or Part-A, together with the employee’s information. This section also contains the pay details and the TDS that is taken from it. The full details of the compensation, deductions, and taxes are included in Part B. This includes gross salary, exempt allowances under section 10 like HRA, standard deductions like deductions under section 16, and deductions under Chapter 6-A. Like 80C and 80D and tax details are included.

This is how Form-16 can be useful.

When filing their income tax return, taxpayers are advised to carefully compare the data in Form-16 with the pre-filled data they got from the government. By doing this, the potential for ITR errors is decreased, and there is little chance that the Income Tax Department will ever send out a warning.

Read More: The new MG Astor Facelift will have a 360-degree camera, a sunroof

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |