Experts caution that many salaried workers are unaware that their company has not been depositing payments until it is too late, or that their money has been locked away due to a straightforward KYC blunder.

Because they believe it will grow silently until retirement, many paid employees neglect to monitor their Employees’ Provident Fund (EPF) accounts for years.

Why would you neglect your EPF if you would leave your bank account unopened for years?

As you work through the 9–5 grind, your EPF account is growing steadily in the background. Think of it as your financial time capsule. However, what would happen if you opened it one day and discovered a large portion was gone? Or worse, years without any updates?

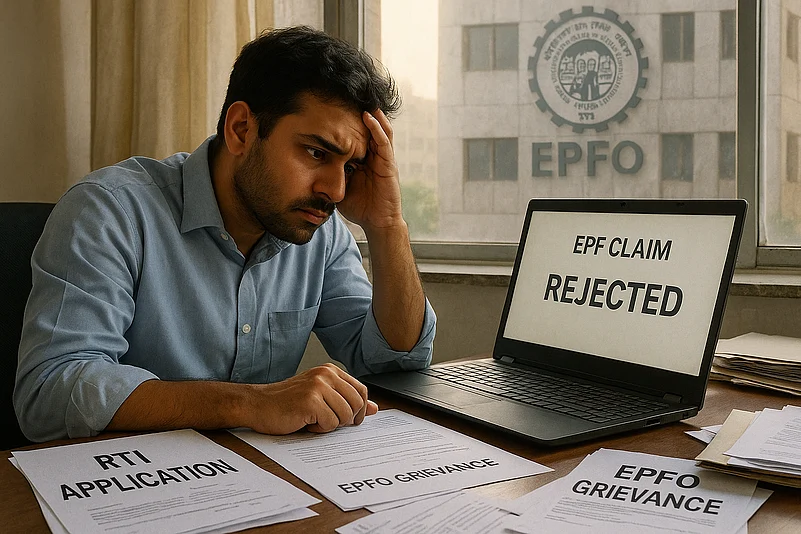

According to experts, a lot of salaried workers are unaware that their company hasn’t been depositing money until it’s too late or that their money has been locked away due to a straightforward KYC blunder. By then, the harm has already been done to your finances and mental well-being.

Employees should monitor their EPF accounts, according to Abhishek Kumar, founder of SahajMoney.com and a SEBI-registered investment advisor. “It keeps one informed about the growth of their retirement savings and interest accrual,” he stated.

Making sure that your employer is correctly depositing the funds is a key reason to check your EPF on a regular basis. Employers occasionally take the Employee Provident Fund (EPF) amount out of employees’ paychecks but neglect to deposit it with the EPFO. According to Abhishek, “Checking the EPFO balance helps in identifying such issues early on.”

When consumers stop monitoring their EPF accounts for an extended period of time, they encounter a number of additional issues. “Old KYC information, missing or delayed employer contributions, and technical errors that can render funds inaccessible or cause withdrawal delays are common issues,” he stated.

Long-term losses to your money can also result from inaccurate or missing deposits. This can eventually lead to a lower-than-anticipated retirement fund. “One’s retirement corpus and the compound interest they accrue over time are diminished by missing or inaccurate deposits. This can restrict their access to EPF benefits and have a major effect on their post-retirement financial security,” Abhishek continued.

It’s critical to take prompt action if an employee discovers any errors in the EPF account, whether they relate to contributions or KYC information. In order to resolve disagreements, he suggested that workers first speak with their employer. If this is not possible, they should then take the matter to the EPFO grievance system. Employees can also update their information online via the EPFO Member Portal for KYC-related issues.

Recent technological advancements and regulatory improvements have made it simpler to track EPF accounts.

Aadhaar-based authentication for transfers, the elimination of some documentation requirements, and the impending EPFO 3.0 platform—which will provide features like ATM card withdrawals, auto-claim settlements, and simpler self-correction of personal details—are all part of the recent system upgrade that EPFO has implemented, according to Abhishek.

(Disclaimer: This article’s expert/brokerage comments, suggestions, and recommendations are their own and do not represent the viewpoints of the India Today Group.) Before actually making any trading or investment decisions, it is advised to speak with a licensed broker or financial advisor.

Read More: Car Safety Tip: Engine Locking Feature Prevents Vehicle Theft

| Join Our Group For All Information And Update, Also Follow me For Latest Information | |

| Facebook Page | Click Here |

| Click Here | |

| Click Here | |