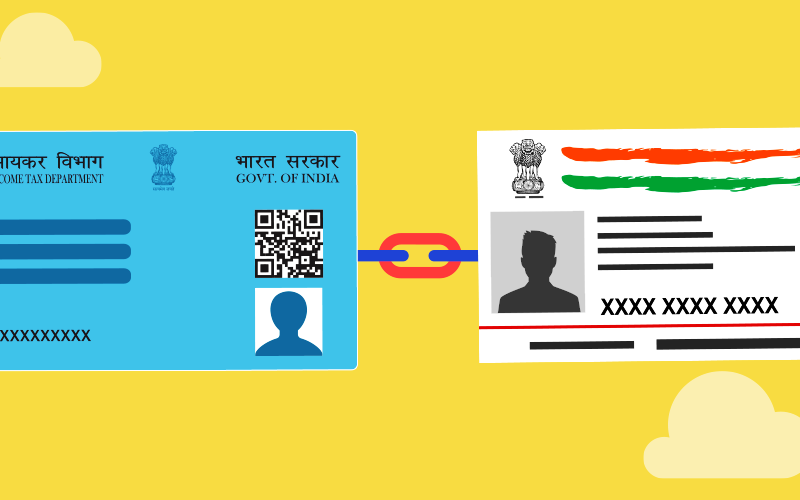

For tax purposes, PAN cards act as the special identifying number for both persons and companies in India. Financial transactions are conducted using PAN cards. The PAN card and Aadhaar card should be linked (link PAN and Aadhaar card) at the same time.

An exclusive ten-digit alphanumeric number

known as a Pan Card is given out by the Indian Income Tax Department in the form of a laminated plastic card (commonly known as PAN card). For the purposes of taxation, it acts as a special identification number for people and companies in India. Financial transactions are conducted using PAN cards. The PAN card and Aadhaar card should be linked at the same time.

With effect from 1 July 2017

a new section 139AA of the Income Tax Act of 1961 created by the Finance Act of 2017 makes it necessary to include your Aadhaar number when requesting a PAN or filing an income report. If you haven’t already, you must link PAN and Aadhaar card before March 31, 2023.

PAN Card

From April 1, 2023, you won’t be allowed to use a PAN card if it isn’t linked. The 10-digit unique alphanumeric number will be deactivated and the PAN card will be closed once the PAN card bearer misses this deadline. In this situation, confirm whether or not your PAN card is connected to your Aadhaar card.

How to verify the status of the link PAN and Aadhaar card

- Navigate to ‘Quick Links’ on the e-filing site homepage and click on Connect Aadhaar Status.

- Click the link labeled “See Aadhaar Status” and enter your PAN and Aadhaar number.

- Upon successful verification, a notification describing your Connection Aadhaar Status will be shown.

Read More: Investment in these Post office schemes will give you good returns!

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |