People must pay income tax if their income is taxable. There are various tax brackets for different income levels, and ITR is filed in accordance with these brackets. It is very vital to be aware of modifications the government has made to the income tax slab at the same time. Nirmala Sitharaman, the finance minister, made this change announcement in the Budget 2023.

Income tax return

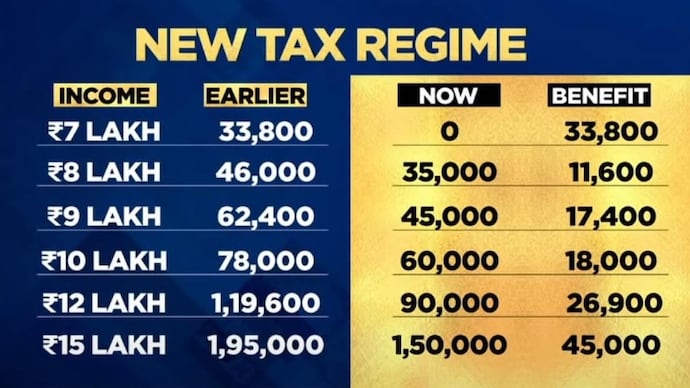

There are now two ways to file an income tax return in the nation. One income tax return is submitted under the previous tax law, and the other is submitted under the new tax law. Nirmala Sitharaman, the finance minister for the Modi government, proposed certain adjustments to the new tax structure when she presented the Budget 2023. Along with this, the new tax system announced a modification to the income tax slab.

According to the new income tax slab,

if a taxpayer files an ITR under the new income tax slab. He will no longer be required to pay taxes on his three lakh rupee annual income. Previously, this ceiling was set at Rs. 2.5 lakh annually. After that, a 5% tax will need to be recorded on any income beyond Rs 3-6 lakh per year. Additionally, a 10 percent tax will need to be recorded on an annual income between Rs 6 and Rs 9 lakh.

Tax Slab

On the other side. Those with yearly incomes between Rs 9 and Rs 12 lakh will be subject to a 15% tax. In addition, a 20% tax must be filed if a person’s annual income is between 12 and 15 lakh rupees. People would also be required to file a 30% tax return for income over Rs 15 lakh. In response, the government has established 6 tax slabs under the new tax framework.

Read More: Recently launched Maruti Fronx is being challenged by these 2 new SUVs!

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |