On February 1st, Finance Minister Nirmala Sitharaman will deliver the budget for the sixth time in a row. This year will see the presentation of an interim budget because it is Lok Sabha election year. According to a senior Income Tax Department official, the interim budget for 2024 would not see an increase in tax exemptions under the new tax regime. On February 1st, announcements about the budget will be made. Previous media sources said that taxpayers under the new tax regime would be eligible for a vote-on-account personal income tax refund limit hike from the existing Rs 7 lakh to Rs 7.5 lakh.

Income tax exemption without a rebate plan

Under the condition of anonymity, an official from the Income Tax Department informed Moneycontrol that there is no intention to provide a refund for exemption. Under the new tax regime, the income tax rebate maximum for taxpayers was raised from Rs 5 lakh to Rs 7 lakh by Finance Minister Nirmala Sitharaman last year. The previous Rs 2.5 lakh basic exemption ceiling was raised to Rs 3 lakh. Additionally, the central government began deducting Rs 15,000 from the family pension.

Benefits of the Rs. 50,000 standard deduction

In the budget for 2023, the new tax regime introduced the standard deduction for salaried class members, retirees, and family pensioners. Pensioners and members of the salaried class benefited from a standard deduction of Rs 50,000 under the previous tax system. According to a different official, the Centre is anticipated to declare TDS exemption on overseas credit and debit card expenditures up to Rs 7 lakh per financial year in the interim budget.

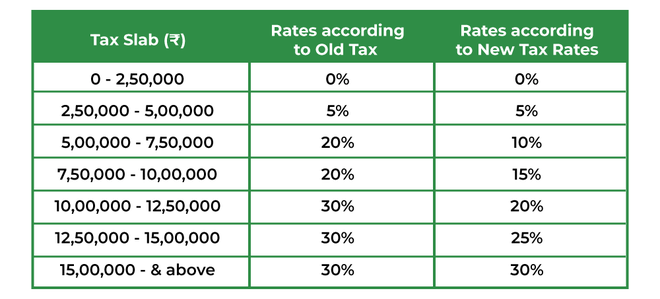

By altering the tax slab

in comparison to the previous one, a concessional rate for the new tax regime was introduced. All taxpayers, including Hindu Undivided Families (HUF) and the Union of Persons (NOP), were subject to it. The personal regulations in Budget 2023 were simplified and income tax slabs were reduced from 7 to six.

> There will be no tax on income up to Rs 3 lakh.

> 5% tax up to income of more than Rs 3 lakh – Rs 6 lakh.

> Above Rs 6 lakh and up to Rs 9 lakh it is 10 percent.

> From Rs 9 lakh to more than Rs 12 lakh, this tax is 15 percent.

> 20 percent tax on income between Rs 12 lakh to Rs 15 lakh.

> 30 percent tax on annual income above Rs 15 lakh

It has been made plain by the

administration that those who choose the new tax scheme. They will not be eligible for any of the following exemptions and deductions: HRA, LTA, 80C, and 80D. Different kinds of exemptions are currently offered under the previous tax system.

Read More: Flipkart Republic Day Sale to start on Jan 14! discount on these phones

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |