For those who pay income taxes, there is some crucial news. The Central Board of Direct Taxes (CBDT) has released the income tax return form for the current fiscal year 2023–24. ITR Forms 1 and 4 have undergone numerous modifications this time around by CBDT. This time, you need to be aware of these changes before filing your ITR.

This time, three months before the fiscal year ends,

the administration has made these forms available. The deadline for completing the Income Tax Return form is July 31, 2024, also this time. The government has only seven months left before the deadline if these forms are to be believed.

What modifications have been made to the ITR Form?

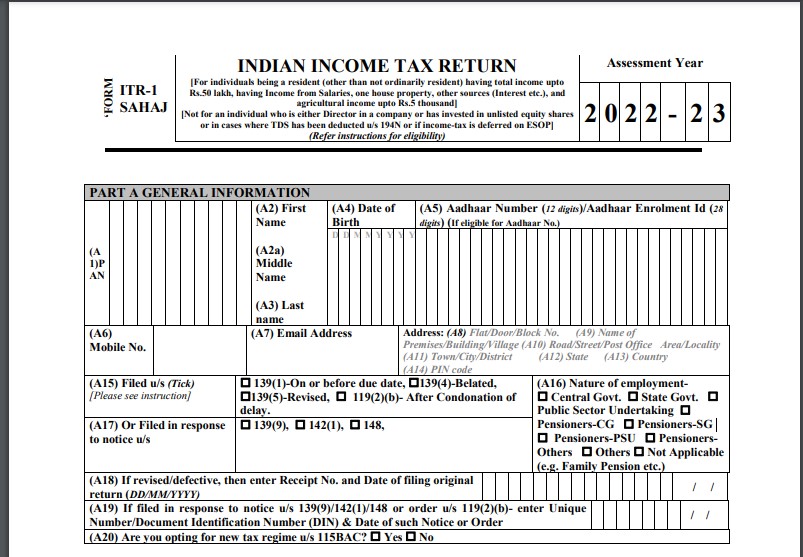

1. This time, the form has undergone numerous modifications. Section 115BAC has also been altered as a result of these modifications. We would like to inform you that Individual, HUF, AOP, BOI, and AJP will now have the new tax regime as their default choice. In addition, those who choose not to participate in the new tax scheme must do so. Such individuals may alternatively choose to use the previous tax system.

2. In addition to this, a separate column has been provided to reflect the deduction to be made under section 80CCH on the updated ITR Forms 1 and 4 that were released this time.

3. The Finance Act 2023 contains Section 80CCH. In addition, starting on November 1, 2022, everyone taking part in the Agnipath Scheme is eligible for a tax benefit for their contributions to the Agniveer Corpus Fund.

4. In addition, taxpayers will now be required to provide comprehensive details regarding all of their bank accounts and cash transactions for the entire year.

ITR Form 1

About ITR Form 1, this form is intended for those earning up to Rs 50 lakh annually. The income is inclusive of your salary, pension, and any additional sources up to Rs 50 lakh. In addition, an additional Rs 5,000 in revenue from agriculture has been added.

ITR Form 4

Aside from this, ITR-4 pertains to limited liability partnership corporations and Hindu Undivided Families. You must complete Form 4 if your annual income is Rs 50 lakh or greater. You will also need to provide details regarding the year’s cash. A new column dedicated to cryptocurrencies was established last year.

Read More: Apple to launch these five devices in New year! including GPT to Watch Series 10

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |