There are five days left in the year 2023 before it ends and the new one begins. Most businesses request that their staff members produce investment certificates at the end of the year in order to save taxes. It’s also possible that your firm sent out an email requesting details in this respect. If not, it is imperative that you investigate the reason for this. The Finance Ministry set the default option for salaried taxpayers to be the “New Tax Regime” with this year’s budget. If you fail to notify the company in this scenario, you will be subject to income tax under the New Tax Regime.

Income up to Rs 7.5 lakh is tax-free.

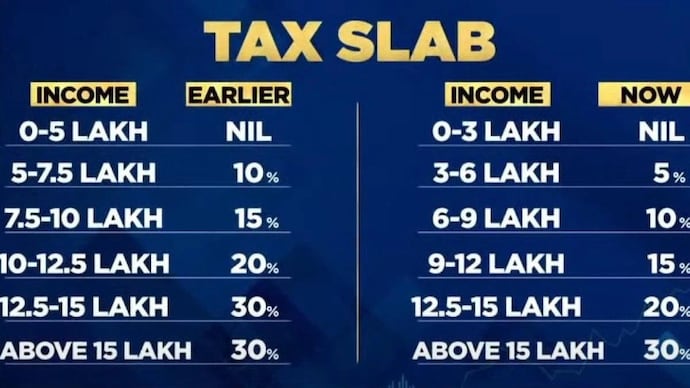

The Finance Ministry raised the new tax regime’s cap in the budget that was unveiled on February 1, 2023, to support it. To give tax relief under the new tax regime. Wide tax slabs at the top level and lower tax rates were established. You would not be required to pay any tax under the new tax regime. If your taxable income is up to Rs 7 lakh. Anybody with taxable income up to Rs 7.5 lakh will pay no income tax. if you include the standard deduction of Rs 50,000, which was reinstated this year.

Old tax regime on higher salary

You are no longer qualified for the tax exemptions and deductions offered under the old tax system after choosing the preferable system. Knowing whether you have chosen the old tax regime or the new tax regime in a case like this. Income tax on higher salaries under the previous tax system can also be saved if you have invested in the Finance Ministry’s tax rebate program. Under the new tax structure, your firm would have already deducted your tax if you had not told them about this. You are unable to alter the tax regime once it has been chosen during the fiscal year. This kind of issue is about to arise.

How to prevent making the wrong choice

Additionally, there is a technique to prevent choosing the new tax regime by accident. Experts state that while filing their income tax return, taxpayers can choose the previous tax regime. This means that your withheld tax will be refunded to the PAN-linked account following the submission of the return. If your employee has had any additional taxes withheld from them, you can seek a refund by filing an ITR claim. You should be aware, nevertheless, that not all exemptions can be claimed at the time of ITR filing. For LTA, there is no claim of exemption. But you are eligible for an HRA exemption.

Read More: Income Tax makes big changes in the ITR Form 1 & ITR Form 4!

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |