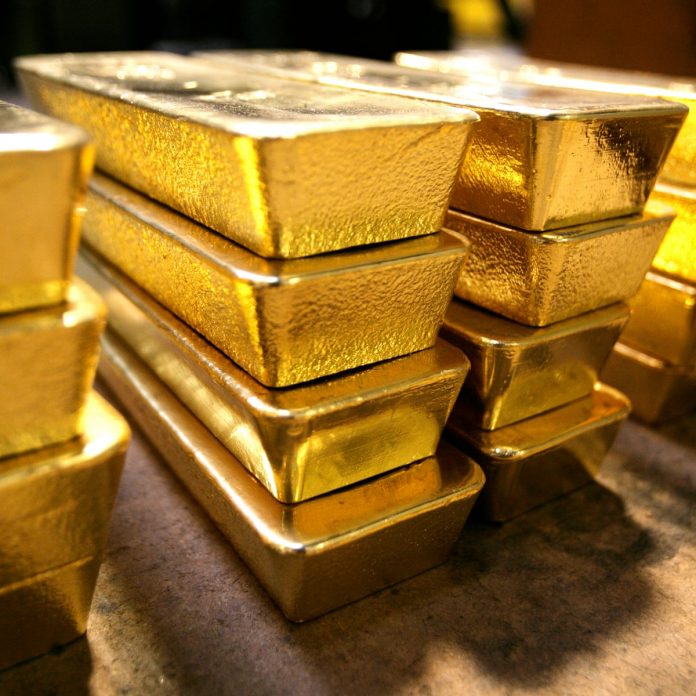

Sovereign Gold Bond Scheme 5: From today you are going to get another chance to buy cheap gold. The sale of the fifth series of Sovereign Gold Bond Scheme 2021-22 (Sovereign Gold Bond Scheme 2021-22 – Series V) is starting today. Let us tell you that this scheme is open for only five days (from August 9 to August 13). During this time you will be able to buy gold at a lower price than the market. Sovereign Gold Bond is issued by the RBI on behalf of the government. Let us know how and from where you can buy it.

What is the rate?

Under the Sovereign Gold Bond Scheme, you can buy gold at Rs 4,790 per gram. If you buy 10 grams of gold, then you will have to pay Rs 47,900. If you buy gold online, you will get Rs 4,740 per gram of gold.

Where can I buy Sovereign Gold Bonds?

According to the ministry, all banks, except Sovereign Gold Bond Small Finance Bank and Payment Bank, Stock Holding Corporation of India (SHCIL), designated post offices, recognized stock exchanges, National Stock Exchange of India Limited (NSE), and Bombay Can be bought from Stock Exchange Limited (BSE).

after how many years of maturity

The maturity of the Sovereign Gold Bond is 8 years. But after five years, you can exit from this scheme on the next interest payment date. In Sovereign Gold Bond, the investor is required to invest at least one gram of gold. If needed, the investor can also take a loan against the sovereign gold bond, but the gold bond will have to be pledged.

Who can buy Sovereign Gold Bond?

Any individual and Hindu undivided family can buy gold bonds up to a maximum value of 4 kg. For trusts and other similar institutions, this limit has been kept up to the equivalent price of 20 kg of gold. Sovereign Gold Bond can also be bought as a joint customer. It can also be bought in the name of a minor. In the case of a minor, his parent or guardian has to apply for the Sovereign Gold Bond.