The procedure for submitting an income tax return has begun. Tax returns are also being submitted by individuals. People whose income is taxable in India, however, must also file ITR filing. However, some considerations should be made while completing an income tax return. Many forms are utilized anytime an income tax return is filed. These forms should be used to file an income tax return.

There are approximately 9 different types of ITR forms

that can be used by taxpayers to file their taxes. However, the Central Board of Direct Taxes in India states that when submitting returns, people should solely focus on the forms listed below:

ITR-1

ITR-2

ITR-2A

ITR 3

ITR 4

ITR 4S

Only businesses and firms are required to use the following income tax return forms:

ITR-5

ITR-6

ITR-7

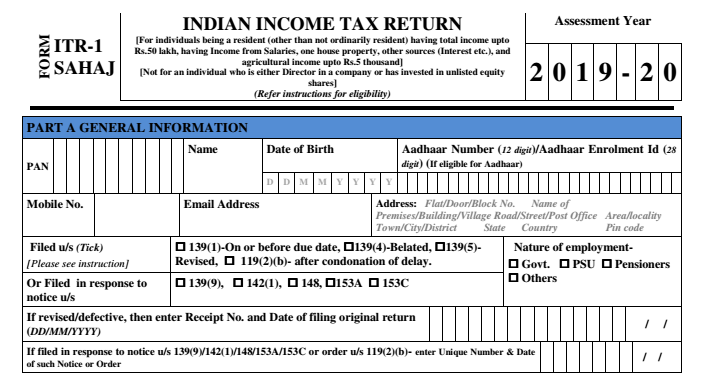

ITR-1

This ITR filing form, also known as the Sahaj Form, is only submitted by an individual taxpayer. This form cannot be used by any other assesses who must pay tax to file their return. The following individuals are eligible to use this form:-

– A person whose income is derived from a wage or other sources, such as a pension.

a person whose primary source of income is a residential property.

-An individual who does not have any income from a second business or from the sale of any assets, such as capital gains during ITR filing.

– People who do not own any real estate or other assets outside of India.

– A person with no income coming from any source outside of India.

– A individual with an agricultural income of less than Rs. 5000.

– A person whose income comes from a variety of sources, such as investments, plans, fixed deposits, etc.

– people who haven’t received any unexpected revenue from things like lotteries or horse races, etc.

ITR-2A Form

The 2015–2016 assessment year saw the introduction of the new ITR-2A income tax return form. A Hindu Undivided Family (HUF) or an individual taxpayer may utilize this form. The following individuals are eligible to use the ITR-2A form:

– Individuals who receive their money via a wage or pension.

– Individuals who also make a living from many residential properties.

– A person who does not earn any money from a second business or from the sale of any assets, i.e., no capital gain.

– Individuals who derive their income from a variety of sources, such as fixed deposits, investments, shares, etc.

– A person who does not own any real estate or other assets outside of India.

ITR-2 forms

are a particular kind of ITR filing form that is typically utilized by those who have made money through the sale of assets or property. Additionally, this form is helpful for those who receive income from sources outside of India. Hindu Undivided Families (HUFs) or individuals can typically use this form to file their IT returns.

ITR 3

An individual taxpayer or a Hindu Undivided Family who works exclusively as partners in a firm but does not conduct any business via the firm may find use for the ITR-3 form. It also applies to people who receive no compensation from the firm’s business operations. This form is typically submitted by taxpayers who have earned taxable income.

ITR 4

This ITR form type is helpful for people who own a business or make a living from any occupation. Without regard to the amount of income earned, this form is appropriate for any type of business, endeavor, or profession. The income from a taxpayer’s business may be combined with any unanticipated gains, speculation, salary, lottery, or other income. Anyone can use this form to file their ITR, including business owners, doctors, and designers as well as agents, retailers, and contractors.

Read More: Good news for taxpayers! Finance Minister confirmed that you would experience this

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |