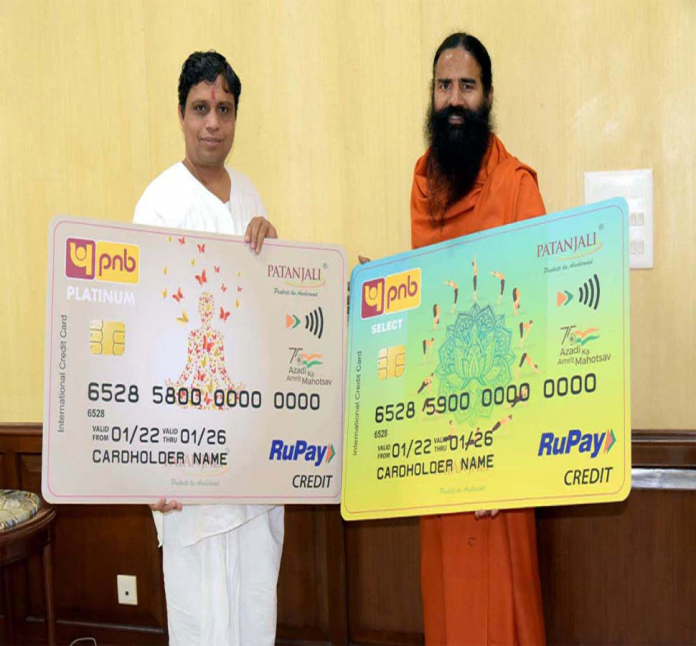

After making a worldwide mark with Yoga and Ayurveda, Patanjali has now launched its own credit card. These credit cards have been launched by Punjab National Bank (PNB) and Baba Ramdev’s Patanjali Ayurved Limited (PAL) in partnership with the National Payments Corporation of India (NPCI). The co-branded credit cards are offered on the National Payments Corporation of India’s RuPay platform and are available in two variants – PNB RuPay Platinum and PNB RuPay Select.

Cashback, loyalty points will be available

Both the co-branded cards offer hassle-free credit service for purchasing Patanjali products along with cashback, loyalty points, insurance cover, and a few other features. It added that for three months from the date of launch of the card, cardholders can enjoy a suitable cashback of 2 percent for transactions above Rs 2500, subject to a limit of Rs 50 per transaction, at Patanjali stores. The cashback limit per transaction is 50. will be

Read More: PM Kisan Samman Nidhi Scheme: How Farmers Can Check PM Kisan Scheme 10th Benefit.

The credit limit up to Rs 10 lakh

The Platinum and Select cards will get an insurance cover of Rs 2 lakh and Rs 10 lakh for accidental death and individual complete disability, respectively. The Platinum Credit Card will get a credit limit of Rs 25,000 to Rs 5 lakh. At the same time, a credit limit of Rs 50,000 to Rs 10 lakh will be available on the Select card. There will be zero joining fee on the Platinum card. However, there will be an annual fee of Rs 500. At the same time, on the Select card, a joining fee of Rs 500 and an annual fee of Rs 750 will have to be paid.