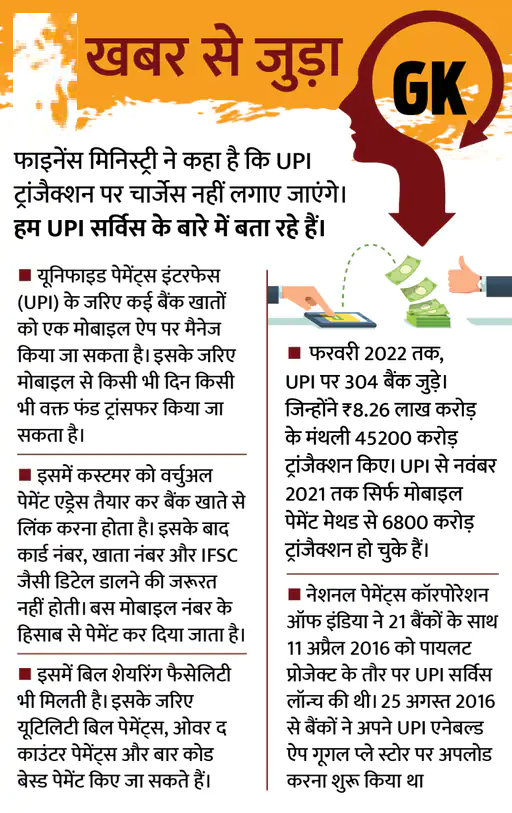

The Finance Ministry on Sunday refuted rumors that the govt might tax UPI payments, which had been mentioned up to its purpose. The administration declared that UPI transactions can still be free. In step with a previous rbi discussion paper, UPI transmits cash in an exceeding manner clone of IMPS, hence it ought to be assessed a similar fund transfer dealings fee as IMPS.

Pole

According to the Finance Ministry, UPI is incredibly sensible for folks. The economy advantages the maximum amount from it. The governing body hasn’t mentioned adding fees to the UPI service. Concerning that, the service supplier is going to be compensated for its expenses in numerous ways. The system for digital payments is receiving funding from the govt.

RBI’s consultation has ignited a discussion.

A few days ago, the rbi asked for opinions on UPI payments and costs from the general public. A consultation document was additionally created obtainable for this. Folks were misled into thinking that the govt would so begin charging for UPI, though the Finance Ministry has already created everything clear.

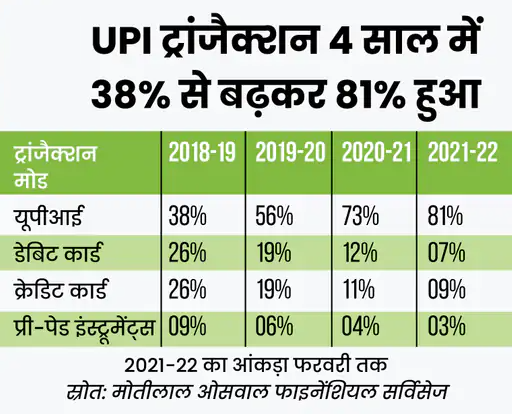

UPI is go by NCPI, whereas rbi is in charge of running India’s RTGS and NEFT payment systems. The National Payment Corporation of India manages systems like IMPS, RuPay, and UPI (NPCI). Starting on Jan 1, 2020, the govt can enforce a framework with zero fees for UPI transactions.

UPI’s introduction has sparked a revolution. The globe of digital payments underwent a change with the introduction of UPI in 2016. Money may well be transferred like a shot to a checking account due to UPI. Digital wallets were well-liked earlier. Wallets need KYC-like hurdles, whereas UPI is exempt from such necessities.

Deals value 600 crores in July 600 crore transactions were created victimization UPI in July, in step with NPCI information. The deal was valued at 10.2 lakh crore rupees. UPI transactions are increasing by 7.16% month over month. The dealings worth is increasing at a yearly pace of 4.76%.

Special UPI-related matters

- Fund transfers using UPI are wiped out in real-time. One application will link many bank accounts.

- You solely want the recipient’s mobile number, account number, or UPI ID to send money to them.

- UPI was created on the IMPS model. This can be why you’ll use the UPI app for banking continuously.

- The use of UPI doesn’t need the utilization of OTP, CVV, card numbers, expiration dates, etc. for online purchases.

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |

Google News Google News |

Click Here |

Twitter Twitter |

Click Here |