The majority of provident fund services are now offered online. Nonetheless, there are still many instances where account holders encounter difficulties when trying to withdraw their EPF. About the Workers Provident Fund, there are numerous sorts of confusion. such as when you are permitted to withdraw funds from it. What are the benefits and drawbacks of cash withdrawals? How is an EPF account transferred?

Few people are aware that EPF accounts are automatically canceled.

Your entire EPF account’s worth of money may become locked in this circumstance. Although you will be able to remove it, doing so will need you to lose time and roll a lot of papads. There is a method after which you will be able to withdraw your money or have it transferred in such circumstances.

The EPF account will be closed in this case.

If the business where you previously worked has closed and you haven’t moved your funds to the account of the new business, difficulties could get worse. If you don’t make any transactions in the account for 36 months in this case, the account will terminate on its own after three years. It will then be connected to the EPF inactive accounts. Indeed, the EPFO classifies provident fund accounts that have not had a contribution deposited for more than 36 months as inoperative accounts. But even on inactive accounts, the interest keeps accumulating.

The account will be certified in this manner.

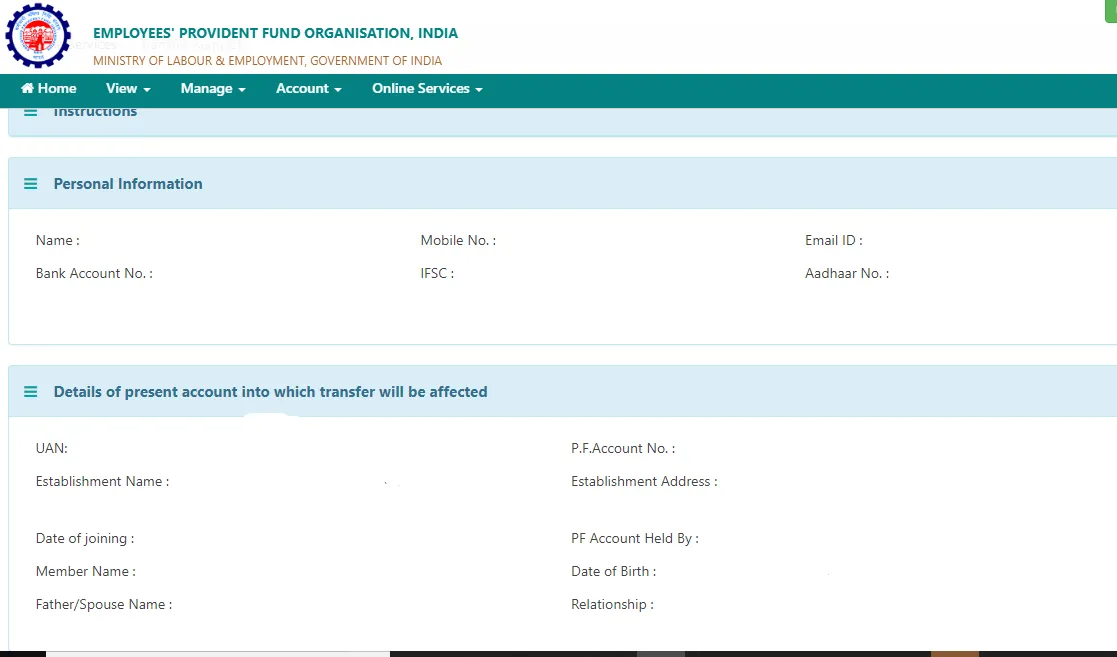

Only after the claim has been certified by the employee’s employer can claims relating to inactive PF accounts be resolved. On the other hand, banks will certify such claims based on KYC documentation if no one is available to certify the company for closure or claim.

They will permit a withdrawal or account transfer.

Following bank Verification. The Assistant Provident Fund Commissioner or other officers would be authorized to approve or deny account transfers based on the requested amount. The Assistant Provident Fund Commissioner’s approval is required if the sum is greater than Rs 50,000. The Dealing Assistant and the Accounts Officer. On the other hand, would be able to grant approval to withdraw or transfer the account. If the sum is less than Rs 25,000 and greater than Rs 50,000.

Read More: UP Police Recruitment notification out! only these people can apply

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |