It is significant to note that a Central Board of Direct Taxes (CBDT) circular specifies that after the PAN card expires, a person is subject to all of the IT Act’s penalties. They will encounter a number of issues, thus it would be best to link the PAN and Aadhaar cards before the deadline.

A PAN Card may not be active.

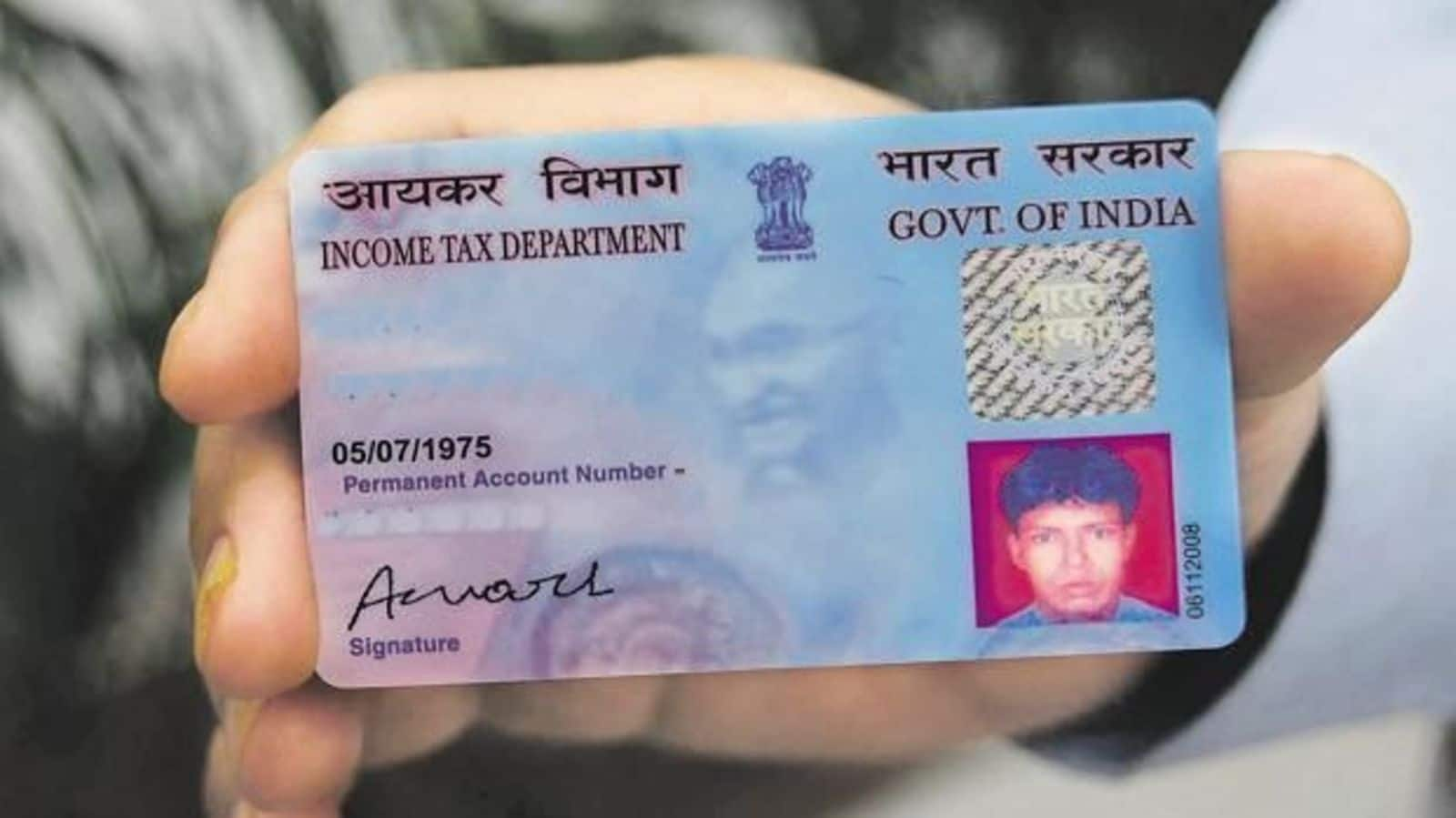

The integration of PAN and Aadhaar cards has become crucial. The government has long provided information to the public on tying PAN cards and Aadhaar cards together. People only have a short time left to link their PAN cards with their Aadhaar cards. If the PAN card and Aadhaar card are not linked PAN card will not work.

The Income Tax Department has extended the deadline

for linking PAN cards and Aadhaar cards until June 30, 2023, leaving only a few days remaining. If this is the case, individuals whose PAN is not connected to their Aadhaar card may do so by paying a fine of Rs 1000 by June 30, 2023. In such a case, there are currently only 45 days remaining to finish this work.

This will occur if the Aadhaar-PAN Card linkage is not done.

- An inactive PAN cannot be used to submit an ITR.

- Your unprocessed returns won’t be handled.

- Your ongoing activity won’t be finished if the returns are defective

- The higher rate will be reduced by the tax.

Linking of PAN and Aadhaar Cards

It is significant to note that the Income Tax Act’s requirements mandate that everyone link their PAN card and Aadhaar card. If anyone wants to avoid the repercussions indicated above, they should all pay attention to the most recent announcements.

Read More: Basic pay for central employees will increase to Rs 27,000!

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |