The income tax department has once more urged people to link the two important documents even though the new deadline of June 30, 2023, is quickly approaching. According to the department, PAN Card holders who do not fall under the excluded category must link their PAN with Aadhaar by June 30 in order to comply.

According to the Income-tax Act of 1961,

PAN Card holders who do not fall into the exempt category must link their PAN with Aadhaar by June 30, 2023, at the latest. The income tax agency has requested that you link your PAN and Aadhaar as soon as possible. Since March 31, 2022, the PAN-Aadhaar linking deadline has been postponed numerous times; the current deadline is June 30, 2023. Even though the deadline is June 30, there is a Rs 1,000 fine if the two important documents aren’t linked. Your PAN would become inactive if your Aadhaar and PAN are not linked.

Aadhaar and PAN Card could no longer be linked until June 30, 2022,

without paying a penalty, after the planned deadline of March 31, 2022. Later, the fine was raised to Rs 1,000 from July 1, 2022. Despite the fact that the PAN-Aadhaar linking deadline was once more extended from March 31 to June 30, 2023, the fine amount is still the same.

How to Use SMS to Link PAN and Aadhaar

1. Enter “UIDPAN” followed by “10-digit PAN” and the 12-digit Aadhaar number.

2. Using the registered cellphone number on your account, send this SMS to 56161 or 567678.

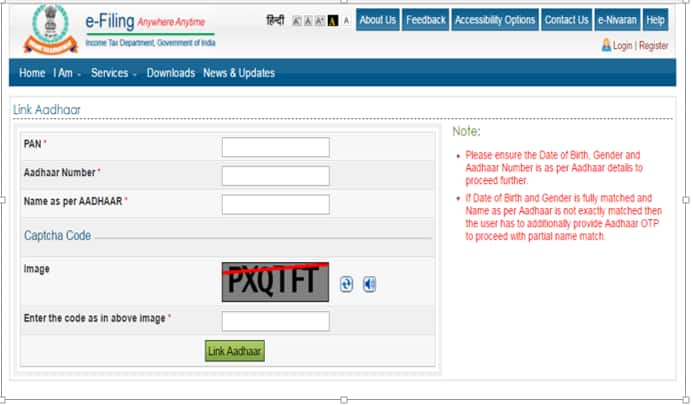

Via the Income Tax Department’s website

- Go to the I-T department’s e-filing portal at https://www.incometax.gov.in/iec/foportal.

- Open the ‘Quick Links’ section of the website and select the ‘Link Aadhaar’ option.

- This will take you to a new page where you must input your name, PAN number, and Aadhaar number, among other things.

Read More: Tata is getting ready to defeat the Hyundai Creta by including CNG in this SUV!

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |