If you haven’t already, link your PAN Card & Aadhaar card as soon as possible. The deadline for free PAN and Aadhaar linking is quickly approaching. Complete this assignment before June 30 to avoid punishment.

The government had agreed to extend the project’s deadline,

which had originally been set for March 31. If PAN and Aadhaar cards are linked after the allotted time period, the Income Tax Department will impose a charge of Rs 1000, which must be paid through a challan. The UIDAI has also published a thorough process for linking PAN with Aadhaar. On the UIDAI website, you can find information about the PAN-Aadhaar linking offline and online processes.

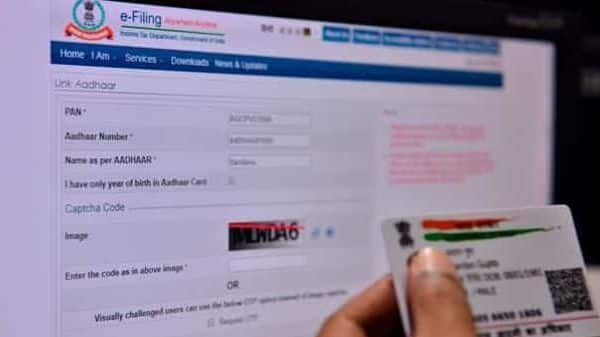

How to link PAN Card with Aadhaar card online

- To connect your PAN and Aadhaar, click the icon.

- Log in to your account after creating one.

- Now enter the information, including your ID, password, and birthdate.

- A pop-up message containing the Aadhaar-PAN link will appear.

- Please enter the necessary information, confirm, and complete the captcha.

- You will then receive a notification that your PAN and Aadhaar card have been successfully linked.

Ways to connect offline

- Visit the service locations of NSDL or UTITTSL, two PAN service providers.

- At the center, you must complete the Annexure-I form.

- Send the form, your PAN card, and your Aadhaar card in hard copy.

- You must pay a small fee here.

- Your PAN and Aadhaar card is now connected.

Ways to connect using SMS

- To link your Aadhaar card and PAN card, send an SMS with the registered cellphone number to 567678 or 56161.

- To send the message, use UIDPAN [12-digit Aadhaar number] [10-digit PAN].

- Wait for the response after the SMS has been sent.

- It is required to link your PAN card and Aadhaar.

- People above the age of 80 and those who live in Assam, Meghalaya, or Jammu & Kashmir are free from this requirement.

Read More: Investing here will help you to avoid paying even a single rupee in income taxes!

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |