An essential document needed for many financial activities is the PAN Card. Should it be misplaced, pilfered, or impaired, you will need to get a replica.

How to obtain an online duplicate PAN card:

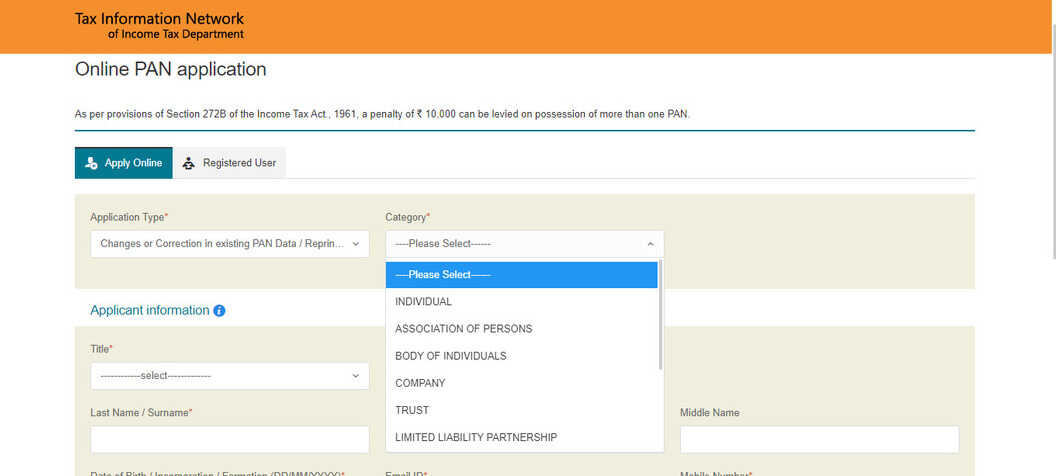

1. Visit the Income Tax Department’s website.

2. Select the tab for “PAN Services”.

3. Select “Request for Duplicate PAN Card” from the menu.

4. Type in your PAN.

5. Type in your address, name, and birthdate.

6. Type in your email address and mobile number.

7. Upload the signed scan to the website.

8. Upload a scan of your driver’s license or Aadhar card.

9. Select the “Submit” option.

After carefully

reviewing your application, the Income Tax Department will issue a duplicate card to you in less than 15 days. Required documents for online applications: Name, PAN, Date of Birth, Address, Phone, Email ID, Signature Scan of Aadhar Card, or Driver’s Licence. Charges for Applying Online: The cost of a duplicate is ₹100. For an extra copy, you can also apply offline. You must visit any regional Income Tax Department office for this.

PAN Card serves these functions.

- Returning Income Tax (ITR)

- establishing a bank account

- Putting Money Into Mutual Funds

- Obtaining a home loan or a personal loan

- making stock market investments

- A Fixed Deposit (FD) is opened.

- purchasing or disposing of real estate

- requesting a visa to travel overseas

You are unable to perform

any of these actions if you do not possess a PAN Card. This is crucial for you: the Income Tax Department website or any regional office makes it simple for you to apply online or offline.

Read More: Porsche unveils the 1.65 crore Macan EV! top speed is 260 kmph

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |