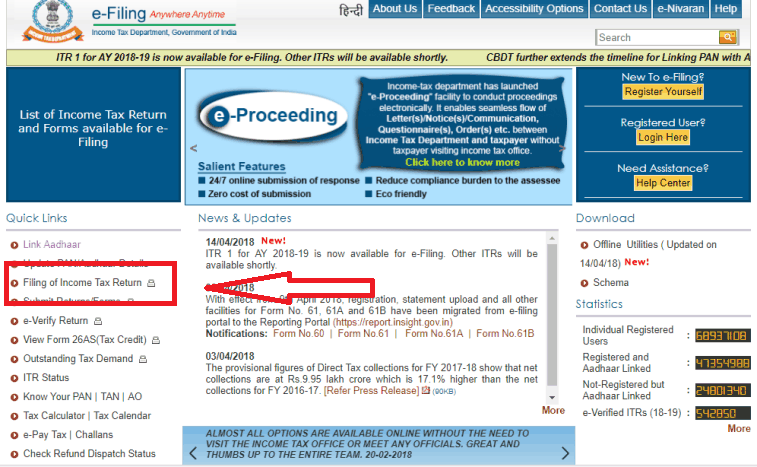

There are currently just two weeks left to file income tax returns. Those that submit ITR beyond the deadline will be fined. The number of persons filing returns rises as the due date approaches.

Filling out ITR is the easiest for them.

Filing taxes is often not difficult for persons who receive a salary. At the same time, the number of people who work as consultants or freelancers rather than in traditional positions has rapidly increased. This work culture has been trending quickly in India since the Corona pandemic. For some people, filing an ITR requires a different procedure. A person cannot fill out ITR-1 or ITR-2 forms as a salaried taxpayer if they are a consultant or freelancer. Because they do not get a salary, these folks will not be eligible for the standard deduction of Rs. 50,000. These individuals can, however, deduct some expenses from their claims.

Select this tax system.

Your tax bracket and rate will be determined by the amount of freelance or consulting income you received last year. You cannot choose your tax system annually as paid persons can. Let’s say you have the choice to select the new tax regime even if the old tax regime is the default option for the financial year 2022–2023—the current assessment year. You cannot change your mind once you’ve chosen the new tax system. The new tax system will take effect at the beginning of this fiscal year.

Understand the prevailing taxes system.

The Income Tax Act allows consultants and independent contractors to choose this program. For such professionals who did not get more than Rs 50 lakh in 2022–2023, the presumed plan under section 44ADA of the Income Tax Act is applicable. This millit will rise to Rs 75 lakh as of the following year. These people can declare a business income of 50% of their total income. Therefore, their tax will be computed. The presumptive plan under 44AD, which has a current ceiling of receipts of 2 crore rupees but will increase to 3 crore next time, can be used if the income is more significant than 50 lakh rupees.

Date for the freelancer to file ITR

Additionally, their income tax return filing date is July 31, 2023. On the other hand, the deadline is 31 October 2023 if the consultant falls under the ambit of the audit under section 44AB. The tax audit report in this situation must be submitted by September 30, 2023. You must complete the ITR-3 form. As before, an ITR-4 form must be completed after selecting the presumed scheme. Only the ITR-3 form needs to be completed if the income exceeds Rs. 50 lakh or if a loss is to be carried forward.

Read More: Avneet Kaur once again created a ruckus on social media with her images

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |