Budget 2025: During the budget presentation, the Finance Minister uses a number of incomprehensible technical terminology to the average person. Understanding the full budget is simple if you are familiar with them.

Budget 2025: The fiscal year 2025–2026 budget is just a few days away. The budget, which is anticipated by both large sectors and the average citizen of the nation, will be presented by Finance Minister Nirmala Sitharaman on February 1. Nonetheless, there are a lot of items in the budget that are incomprehensible. In such a scenario, many things are difficult to understand while listening to the budget speech. Through this news, we will provide knowledge on some of these terms or words so that you won’t have to deal with them on February 1.

Rebate: The amount left over after deductions and discounts is subject to taxation. Rebates reduce the amount of tax that must be paid after determining your tax liability.

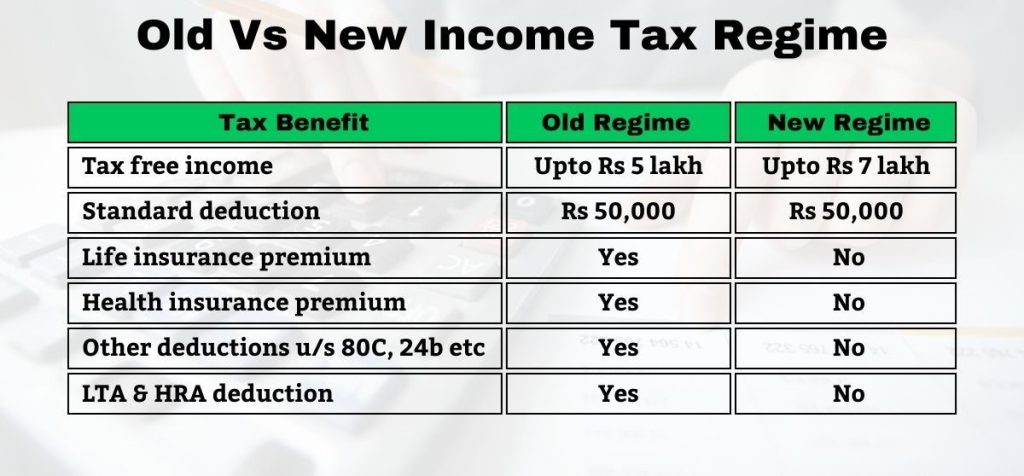

The Old Tax Regime: has four income tax slabs. Under the previous tax system, income over Rs 10 lakh was subject to 30% tax.

New Tax System: The new tax system has seven income tax slabs. The basic exemption level has been raised to Rs 3 lakh as a result, and income between Rs 3 and Rs 7 lakh would be subject to 5% tax.

A general increase in a nation’s pricing for goods and services over a specified period is called inflation.

Direct Tax: This is the tax that a person or business pays to the government directly, either as corporate tax or income tax.

Capital Expenditure (Capex): Businesses invest in capital expenditures to increase their operations, productivity, and efficiency.

Cess is a tax that is applied to all taxes.

Disinvestment occurs when the government sells its stock in public sector companies.

Goods and services are subject to tax collected at the source (TCS). On behalf of the government, the seller collects it from the buyer.

Tax deduction: This is when taxes are subtracted from income and the individual receives the leftover sum; for example, a deduction on a salary or interest on an investment falls under this category.