Pradhan Mantri Garib Kalyan, or PMGKAY The central government launched the Anna Yojana during the COVID-19 pandemic. Under this program, the government has been giving impoverished families free rations ever since.

Free Ration: This information is for you if you also receive free rations under the Central Government’s “Pradhan Mantri Garib Kalyan Anna Yojana” (PMGKAY). Indeed, the government has frequently seen that those who are not eligible are also using the program’s free ration. People who work for the government or pay income taxes are not eligible for rations under the program. In light of this, the Food Ministry will get the data from the Income Tax Department to remove those who are ineligible from the list of recipients under the “Pradhan Mantri Garib Kalyan Anna Yojana” (PMGKAY).

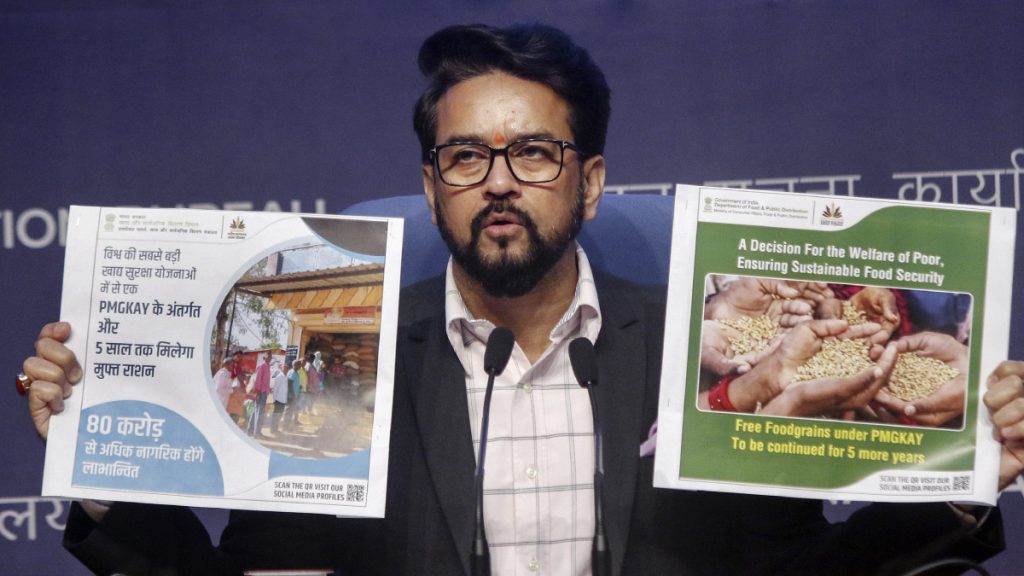

The budget includes a Rs 2.03 lakh crore allocation for the program.

Poor households that do not pay income tax are eligible for free rations under PMGKAY. In contrast to the revised estimate of Rs 1.97 lakh crore for the current fiscal year, the government has allocated Rs 2.03 lakh crore for PMGKAY in the budget for the fiscal year 2025–2026. In order to alleviate the hardships that the poor and needy encountered as a result of the nation’s economic standstill brought on by the Kovid-19 pandemic, the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) was introduced.

In January 2024, the program was extended for an additional five years.

Subsequently, on January 1, 2024, the government extended the PMGKAY free ration distribution limit for five years. In an office order, the Central Board of Direct Taxes (CBDT) stated that the Joint Secretary of the Department of Food and Public Distribution (DFPD) in the Ministry of Consumer Affairs will be able to receive information from the Director General of Income Tax (System). In accordance with the data sharing agreement, DFPD will give the DGLT (System), New Delhi, the Aadhaar or PAN number, and the tax assessment year.

DGIT (Systems) will reply to DFPD with the income calculated using the Income Tax Department database if a PAN is supplied or an Aadhaar is connected to a PAN. DGIT (Systems) will notify DFPD if the beneficiary’s Aadhaar number is not associated with any PAN in the Income Tax database. DGLT (Systems) and DFPD will determine such a response and the mode of information exchange. DGIT (Systems) will sign a Memorandum of Understanding (MoU) with DFPD to streamline the information submission procedure. The terms of the Memorandum of Understanding will cover post-use shedding, data transfer procedures, confidentiality, and safe data archiving.

Read More: PNB Recruitment 2025: No Exam, Salary Up to ₹1.75 Lakh! Apply Now

| Join Our Group For All Information And Update, Also Follow me For Latest Information | |

| Facebook Page | Click Here |

| Click Here | |

| Click Here | |