PhonePe IPO: In December 2022, PhonePe moved from Singapore to India. It had to pay the government approximately Rs 8,000 crore in taxes for this.

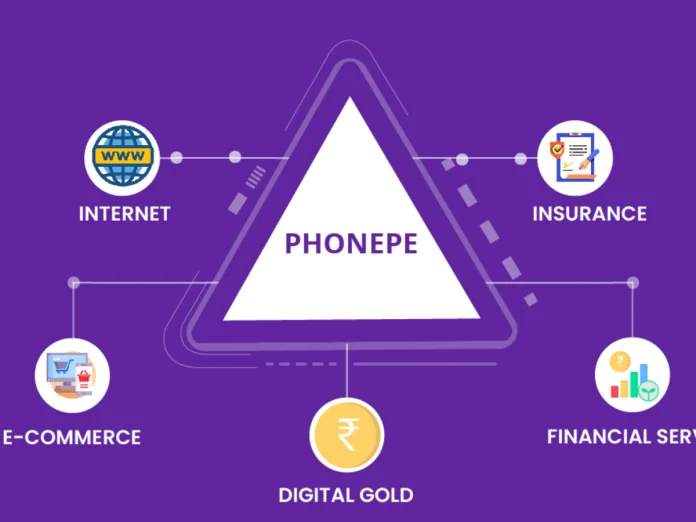

PhonePe, the biggest financial business in India, is getting ready to go public. The business announced on Thursday that it has begun getting ready for a potential IPO so that it might list on the nation’s stock exchanges. At the time of its most recent financing round in 2023, the company was valued at $12 billion.

“The company is taking initial steps regarding its potential IPO and plans to list on the Indian stock markets,” a statement from PhonePe stated. For the company, which is celebrating its tenth anniversary this year, this is a momentous milestone. The business has expanded to provide cutting-edge financial services and technological solutions to lakhs of clients.

In December 2022, PhonePe moved from Singapore to India. It had to pay the government a levy of almost Rs 8,000 crore for this. With over 48% of the Unified Payments Interface (UPI) market, the Bengaluru-based company is the biggest provider of digital payment services in the nation.

The National Payments Corporation of India (NPCI) runs the real-time mobile payment platform PhonePe. With a market share of about 37%, Google Pay is ranked second in this category.

NPCI is working to challenge dominance.

To boost competition in UPI and break the dominance of two companies in this industry, NPCI is continuously urging other fintech apps. No non-bank third-party app was allowed to hold a greater than 30% market share, according to a previous NPCI regulation. However, this rule proved difficult to implement and NPCI had to extend its deadline twice. Its latest extension was done till 31 December 2024, as it could cause inconvenience to the customers.

Effect on the IPO of PhonePe

Sameer Nigam, the creator of PhonePe, had stated that the company would not intend to launch an IPO (Initial Public Offering) until the market share cap was clarified. He stated, “The 30% market share limit on UPI is a big challenge for us.”

Read More: Maruti Swift vs Dzire: Key Differences & Design Choices Explained

| Join Our Group For All Information And Update, Also Follow me For Latest Information | |

| Facebook Page | Click Here |

| Click Here | |

| Click Here | |