This news will reassure you if you are concerned that the bank would raise the interest rate. In its 43rd Monetary Policy Review Meeting (MPC Meeting), the Reserve Bank of India (RBI) did not alter the repo rate. The repo rate has remained at the same level for the second time in a row. The repo rate was last held at 6.5 percent during the MPC meeting in April.

In a year, the repo rate jumped by 2.5 percent.

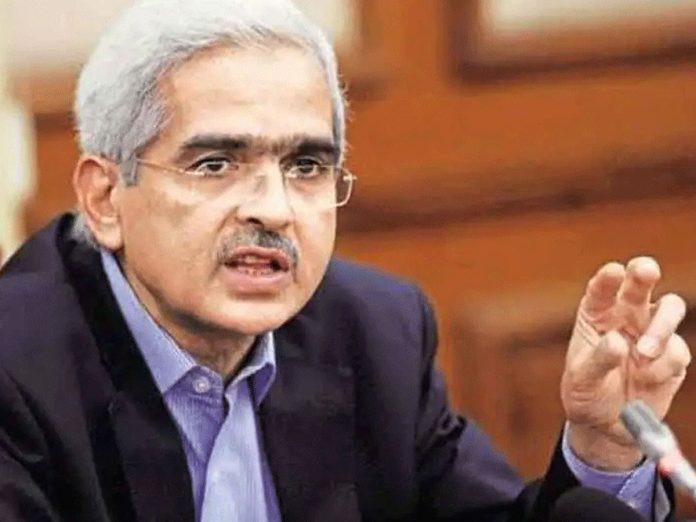

The repo rate has been maintained at 6.5 percent by consensus, according to information provided by RBI Governor Shaktikanta Das about the decision made in the Monetary Policy Committee meeting (MPC meeting). Let us inform you that the RBI raised the repo rate by 2.5 percent starting in May 2022 in an effort to rein in the growing inflation rate. Last year, the repo rate was 4 percent; this time, it is 6.5 percent.

The repo rate is at a four-year high.

At this time, the repo rate is at its highest level in the previous four years. The Reserve Bank raised the interest rate in an effort to curb the increasing inflation rate. As a result, the retail inflation rate decreased to 4.7 percent, its lowest level in 18 months. It was at 5.7 percent at the beginning of March.

How the stock market is doing

On Thursday morning, the stock market opened with a small drop. Before the MPC results, the market was showing signs of sluggishness. However, the stock market is booming following the RBI’s declaration that the repo rate has not changed. The Sensex is up 162.52 points at 63,305.48 points as of 10:20 a.m., and the Nifty is up 46.40 points at 18,772.80 points.

Who will be benefited?

Bank loan customers will gain from the repo rate being unchanged. There is currently no chance of banks raising the interest rates on any form of loan. If the RBI raised the repo rate, the effect would be felt in the loans provided to clients.

The repo rate is what?

Repo rate refers to the interest rate at which the RBI lends money to banks. Banks will be charged more for loans from the RBI if the repo rate is raised. This will result in higher house loans, auto loans, and personal loan interest rates, which will directly affect your EMI.

Read More: Today is the deadline for SSC CHSL 2023 registration, know the exam schedule

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |