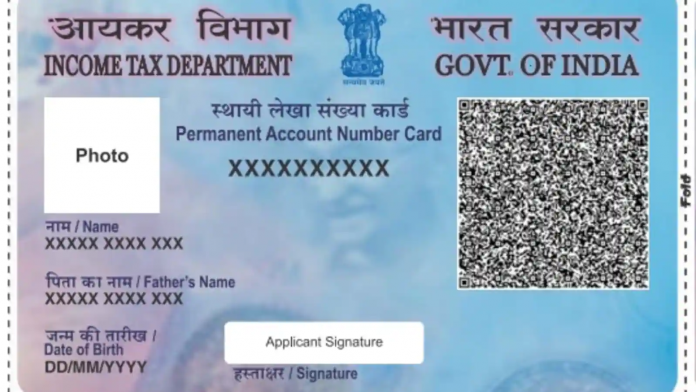

PAN Card: Permanent Account Number is a 10-digit alphanumeric code, which keeps a complete record of the financial history of an individual. It is issued by the Income Tax Department.

PAN Card: PAN card is an essential document for any kind of financial transaction in the country. If you want to take a loan or take a credit card or invest somewhere, file an income tax return, or open an account in the bank, then a PAN card is required. A permanent Account Number is a 10-digit alphanumeric code, which keeps a complete record of the financial history of an individual. The Income Tax Department issues it, but if there is any mistake in the PAN card or the photo has become blurry and out of date, you can change it yourself. In just 5 minutes, the work will be done sitting at home.

Follow this method to change the photo on the PAN card

> Visit the official website of NSDL https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html.

> On the opened page click on the Application Type option and select Change or Correction in the existing PAN data option.

> Now select the Individual option from the category menu.

> After that fill in all the required information and click on submit.

> Now proceed to the PAN application itself and select the option of KYC.

> After that the option of ‘Photo Mismatch’ and ‘Signature Mismatch’ will appear.

> Click on the photo mismatch option to change the photo here.

> Now enter your father and mother’s names and click on the Next button.

After filling in all the details, attach Identity Proof, Address Proof, and Death Proof of Birth Proof.

> After that tick on declaration and click on submit button.

The application fee for change in photograph and signature for India is Rs 101 (Exclusive of GST) and Rs 1011 (Exclusive of GST) for address outside India.

> After the complete process, a 15-digit acknowledgment number will be received.

> Send the printout of the application to the Income Tax PAN Service Unit.

> Application can be tracked by acknowledgment number.

Apply for pan card tatkal

According to the Income Tax Department, it takes about 10 minutes to issue an e-PAN card (e-PAN) through an Aadhaar card for instant PAN. So far about 8 lakh PAN cards have been issued through this facility.

Read More: PAN Card News: Download your e-Pan in no time, know the entire process.

Which documents are required?

To generate a PAN card, a person needs to have identity proof, proof of address, and proof of date of birth. With these ID cards, you will be given many options. You can choose anyone for these proofs.

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |

Google News Google News |

Click Here |

Twitter Twitter |

Click Here |