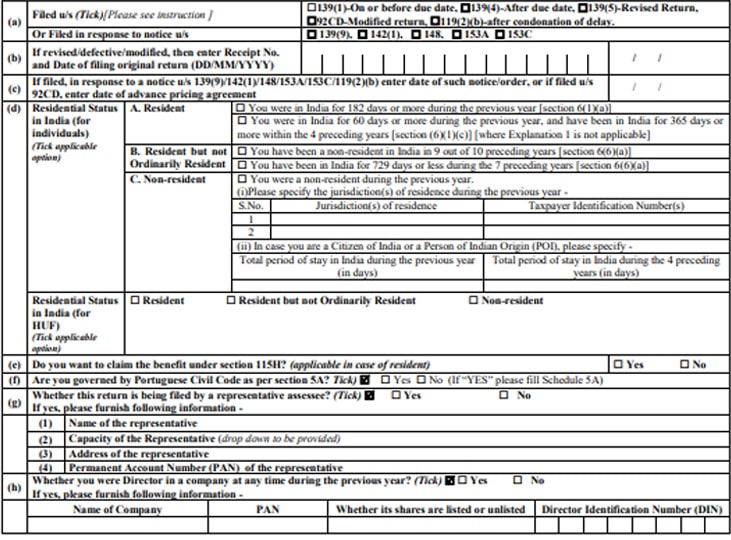

For the financial year 2022–23, the income tax department has released the ITR 2 offline form for filing income tax returns (ITRs). Therefore, taxpayers who are qualified for ITR 2 can access the form on the department’s website and submit their ITR on paper.

A taxpayer can record all income earned

during a fiscal year by completing an ITR. By filing for that year, the taxpayer may request a refund of the excess tax that was paid or deducted during the fiscal year.

ITR 2

Individuals and HUFs (Hindu Undivided Families), whether residents or non-residents, may file Form ITR 2 in relation to the following incomes:

Paycheck or pension

- From one or more residential homes, income or loss

- ‘Capital Gains’-related income or loss

- ‘Other sources’ income, including income subject to special rates of tax.

- According to income tax regulations, any individual or HUF who includes income in the form of interest, salary, bonus, commission, or remuneration from a partnership firm as part of their yearly income is not qualified to file an ITR-2.

The paperwork needed to file an ITR

Salary income taxpayers require a Form 16 from their employer. They require TDS certificates, or Form 16A supplied by deductors, if interest has been earned on fixed deposits or savings accounts and TDS has been deducted on those accounts. To verify TDS on salary and TDS other than salary, they will need Form 26AS. The e-filing portal allowed for the download of Form 26AS. Rent-paid receipts are required for taxpayers living in rented housing in order to calculate their HRA (if they haven’t already sent these to their employer).

Information on ITR forms

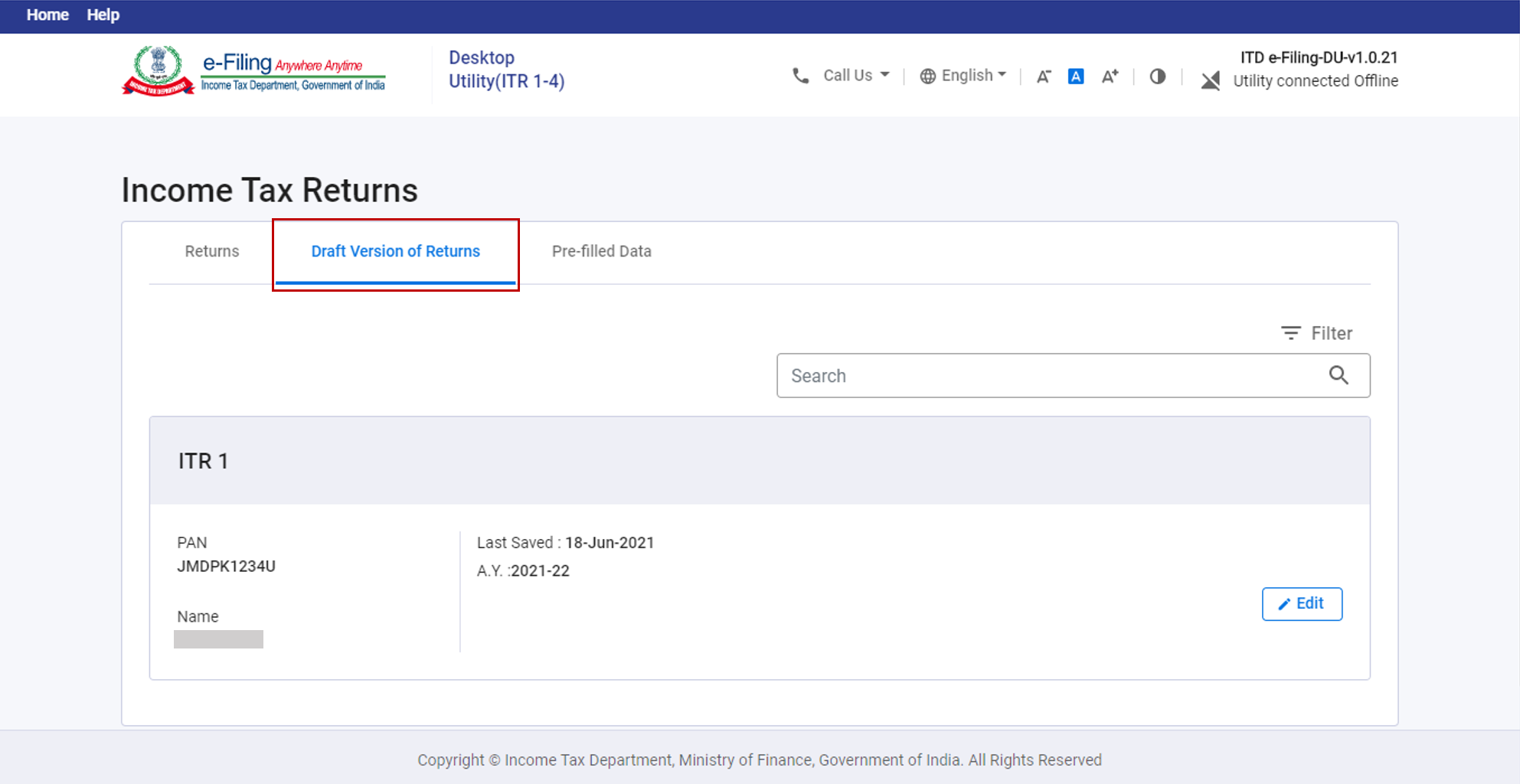

Seven forms have been made available by the Income Tax Department for ITR filing. Sahaj (ITR-1), Forms ITR-2, ITR-3, Form Sugam (ITR-4), Forms ITR-5, Forms ITR-6, and Forms ITR-7 are a few of them. The department announced the offline ITR-1 and ITR-4 forms last month. The department has not yet made the ITR forms available online. As of the right moment, it has made the Excel tool for the ITR-1, ITR-2, and ITR-4 forms available. Taxpayers can enter their income and other information needed for ITR filing using Excel utilities.

Read More: You don’t have to pay taxes under this scheme! government announced this

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |