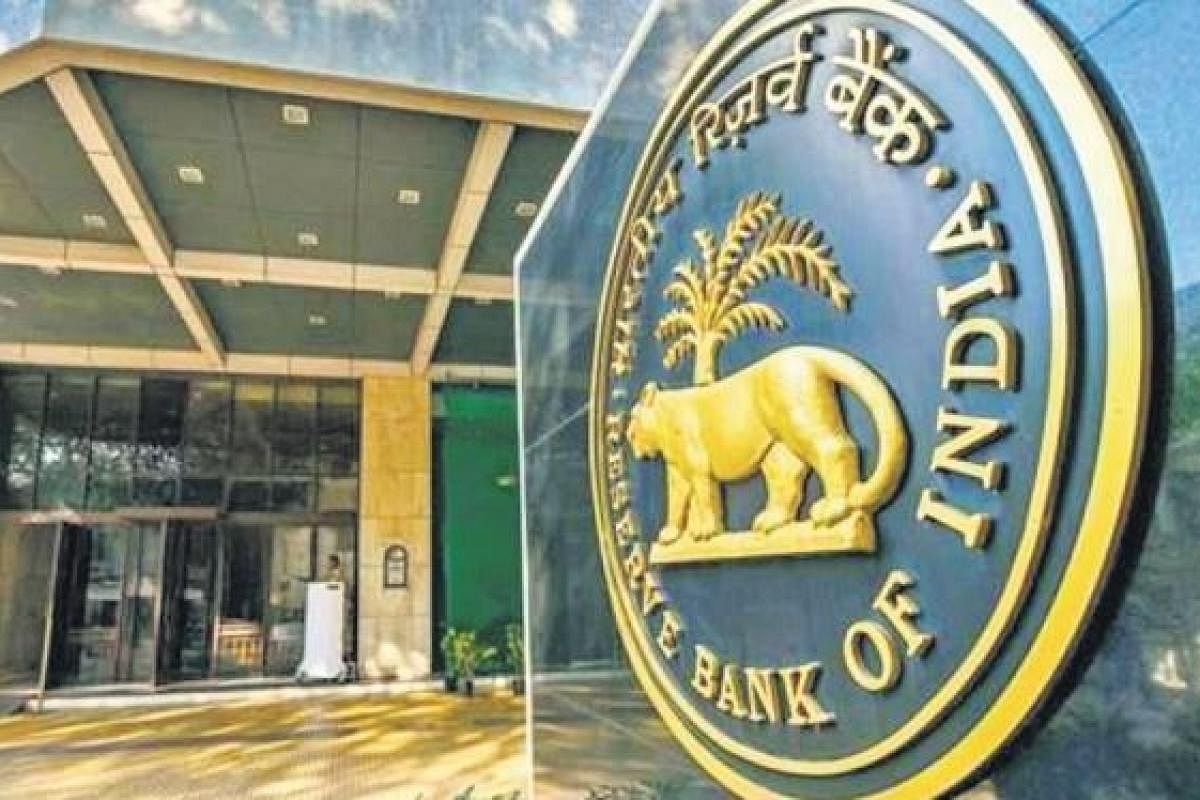

This news will undoubtedly bring you relief. If you, too, have been unable to retrieve money deposited in banks for a considerable amount of time. Yes, the Reserve Bank of India has introduced the Centralised Web Portal Udgam (UDGAM) for the benefit of the general people. The portal’s introduction is intended to find unclaimed funds that have been deposited in banks for an extended period of time. It will be simple to locate the unclaimed money that has been put in various banks thanks to this portal that was created for the public’s convenience.

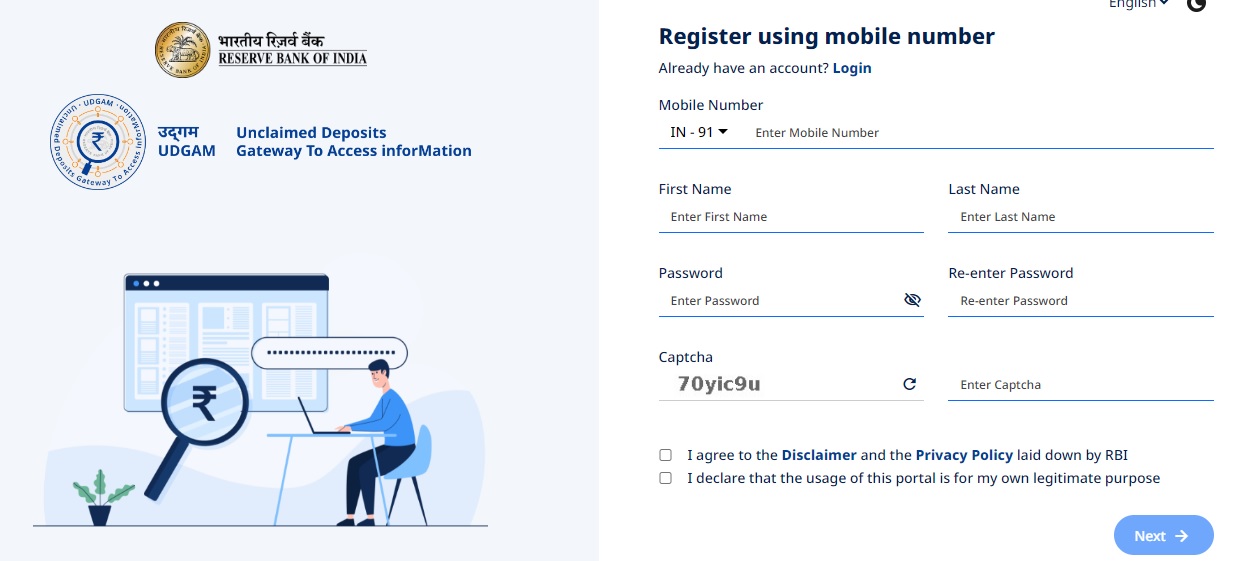

Create an internet platform as your goal

This portal was developed by the RBI to make it easier for users to look for unclaimed deposits across several banks from one location. The banks post a list of unclaimed deposits on their websites. The Reserve Bank has chosen to develop an online platform to make it simpler for depositors and beneficiaries to access such data. With this, potential unclaimed deposits in various banks can be found based on user input.

These banks’ specifics will be made available

The Reserve Bank of India (RBI) announced the opening of a centralized web portal to monitor unclaimed deposits in April 2023. Currently on this platform created by the RBI are the State Bank of India (SBI), Punjab National Bank (PNB), Central Bank of India, Dhanlaxmi Bank Ltd and South Indian Bank. Citi Bank, DBS Bank India Ltd, and South Indian Bank Ltd all have information on unclaimed deposits.

Additionally, information from other banks will be supplied

The UDGAM portal’s launch will assist customers in finding unclaimed savings accounts or FDs. These people will be able to either restart their deposit accounts in the relevant institutions or claim the deposit amount through this. According to information provided by the Reserve Bank. Customers will now be able to obtain information about unclaimed deposits pertaining to seven banks that are available on the portal. In addition, in the near future, information about other banks will also be gradually put on the website.

Let us inform you that by February 2023,

unclaimed deposits of around Rs 35,000 crore had been remitted to the RBI by public sector banks. This money was connected to an account of that kind that hadn’t been active in at least ten years. SBI’s State Bank holds the largest amount of unclaimed funds at Rs 8,086 crore. In addition, Rs 5,340 crore, Rs 4,558 crore, and Rs 3,904 crore are unclaimed amounts at PNB, Canara Bank, and Bank of Baroda, respectively.

Read More: This Maruti 7-seater car is available at the price of Brezza! know the features

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |