October 1st brought about a lot of changes. Income taxpayers will be unable to participate in the Atal Pension Scheme. In addition, a tokenization system has been put in place for card payments. Commercial gas cylinder prices have decreased as well. Here, we’re going to inform you about six such developments that will affect you.

1. More Interest Will Be Available on Small Savings Schemes

The interest rate on numerous modest post office savings plans has been raised by the government. From 5.5% to 5.7%, the interest rate on 2-year time deposits has increased. From 5.5% to 5.8%, the interest rate on 3-year time deposits has increased.

Senior Citizen Savings Scheme interest rates have now raised from 7.4% to 7.6%. The monthly income account scheme will now receive 6.7% yearly interest instead of 6.6% at the same time. The interest rate on the Kisan Vikas Patra has also gone up from 6.9% to 7.0%.

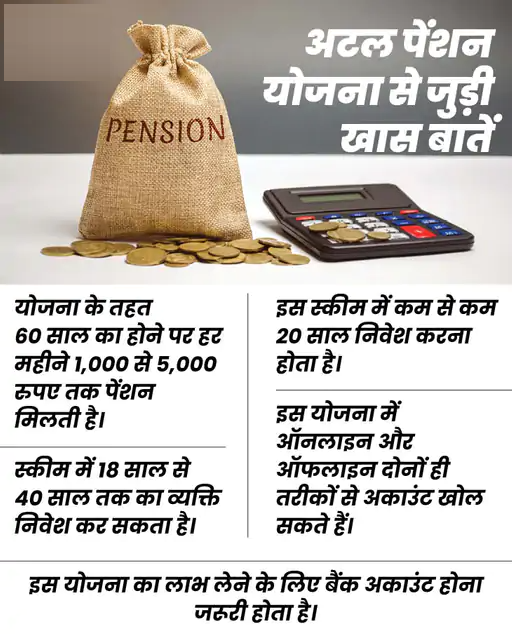

2. Income taxpayers will not be able to invest in Atal Pension Scheme.

Income taxpayers will no longer be eligible to benefit from the Atal Pension Yojana going forward. Any Indian citizen between the ages of 18 and 40 may enroll in this government pension plan under the current regulations, regardless of whether he or she pays income tax. A monthly pension of up to Rs 5000 is provided under this program.

3. Tokenization system will be implemented

For card payments, a tokenization system has been put in place. Merchants, payment aggregators, and payment gateways won’t be able to store customer card information after implementation. The tokenization method is being implemented to stop online financial fraud. Although tokenization is not required, it does make it simple to purchase repeatedly from the same website or app.

4. It is necessary to give nomination details to people

People who invest in mutual funds will now need to provide nomination information. Those investors who don’t must fill out a declaration. The declaration will need to specify the nomination facility.

According to the investor’s needs, Asset Management Companies (AMCs) must offer the option of a nomination form or declaration form in a physical or online format. In the case of the physical option, the investor will sign the form, however, in the case of the online option, the investor will be able to e-sign the form.

5. Commercial Gas Cylinder Cheap

Indian Oil’s price announcement on October 1 indicates a decrease in the cost of a 19-kilogram commercial cylinder. Its cost in the national capital, Delhi, has decreased from Rs 1,885 to Rs 25.50 to Rs 1859.50. The cost has dropped by Rs 36.5 in Kolkata, from Rs 1,995.50 to Rs 1959.00.

Similar to Mumbai, where its price dropped by Rs. 35.5 from Rs. 1,844 to Rs. 1811.50, and Chennai, where it dropped by Rs. 36 from Rs. 2,045 to Rs. 2009. The price has decreased for the sixth time in a row. Domestic LPG cylinder costs have remained the same. In Delhi, a 14.2-kilogram gas cylinder costs Rs 1053.

In addition, the cost of aviation turbine fuel (ATF) has decreased by 4.5 percent. Following this, the cost of jet fuel in the nation’s capital decreased by Rs 5,521.17 to Rs 115,520.27 per kiloliter.

6. Changes in Rules

In relation to Demat Account For those who have Demat accounts, two-factor authentication is now required. NSE states that members will need to connect to their Demat accounts using biometric authentication as one of the authentication factors. A “knowledge factor” could be used for the second authentication. This can be a secret phrase that only the user knows, such as a PIN or password.

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |

Google News Google News |

Click Here |

Twitter Twitter |

Click Here |