In India, people must also pay taxes on their earnings. An ITR is used to file income taxes. People also report their income in this way. ITR is simultaneously filed based on many sources of income. However, you now need to be aware that some people’s income tax will be deducted up to 30%. The financial year 2022–2023’s income must be disclosed in income tax returns until July 31, 2023.

Financial statement

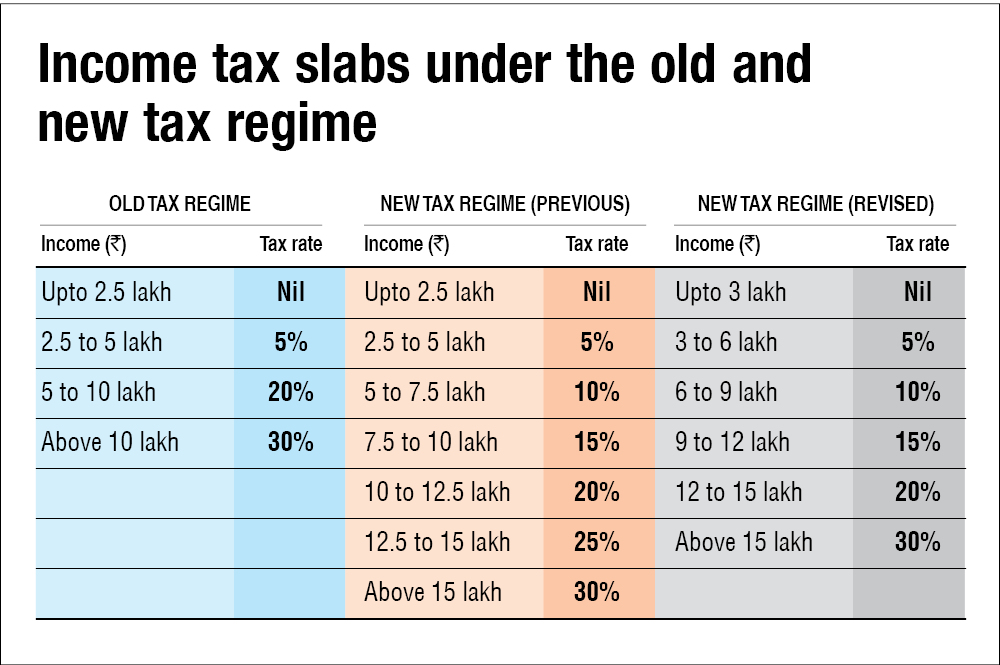

In reality, India has two methods for filing income tax returns. The New Tax Regime is one of these, and the Old Tax Regime is the other. People can view various tax brackets and benefits under both tax systems. Additionally, in both of these tax brackets, a maximum tax of 30% is paid. Additionally, if a person files their income tax return after the deadline, they may also be penalized.

Finance Minister Nirmala Sitharaman made

several significant announcements under the New Tax Regime while presenting the Budget 2023. He had stated that if a taxpayer chooses to submit taxes under the new tax regime in the financial year 2023–2024, he may have to pay a maximum of 30 percent tax. An individual will be required to pay 30 percent income tax under the new tax system if his annual income exceeds Rs 15 lakh.

Old Tax System

On the other hand, if a person files an ITR under the previous tax system in the financial year 2023–24, he may also be required to pay a maximum of 30% tax. A person could have to pay 30% tax under the previous tax system if his income was over Rs 10 lakh when he filed his income tax return.

Read More: Do this thing to prevent misuse of your Aadhaar card! else you may face difficulties

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |