The deadline for filing income tax returns is approaching. Individual income tax returns may be filed up until July 31, 2023. In addition, there are other significant matters that must be attended to when completing an income tax return. It’s important to be aware of any errors when filing an ITR so that they can be fixed. More than one crore Income Tax Return (ITR) was submitted up until June 26, 2020, according to the Income Tax Department.

Financial statement

The deadline to submit an ITR is July 31. According to a tweet from the Income Tax Department, this year’s 1 crore mark was reached 12 days earlier than it was last year. Taxpayers should file their returns as soon as possible and not wait until the final minute. However, there are a few errors that people frequently make while submitting their tax forms. Here is a list of errors to avoid while submitting your income tax return. Let’s discuss them.

Return filing deadline

One common error is failing to submit your Income Tax Return (ITR) by the deadline, which for individuals is July 31 of the assessment year unless the government extends the deadline. The last day is today. However, you can also be required to pay a fine if you don’t submit your ITR before the deadline.

Missing ITR filing

The repercussions of not filing an ITR at all may be more severe. A fine may be applied for failure to file an ITR. Legal action is another option.

False ITR Form

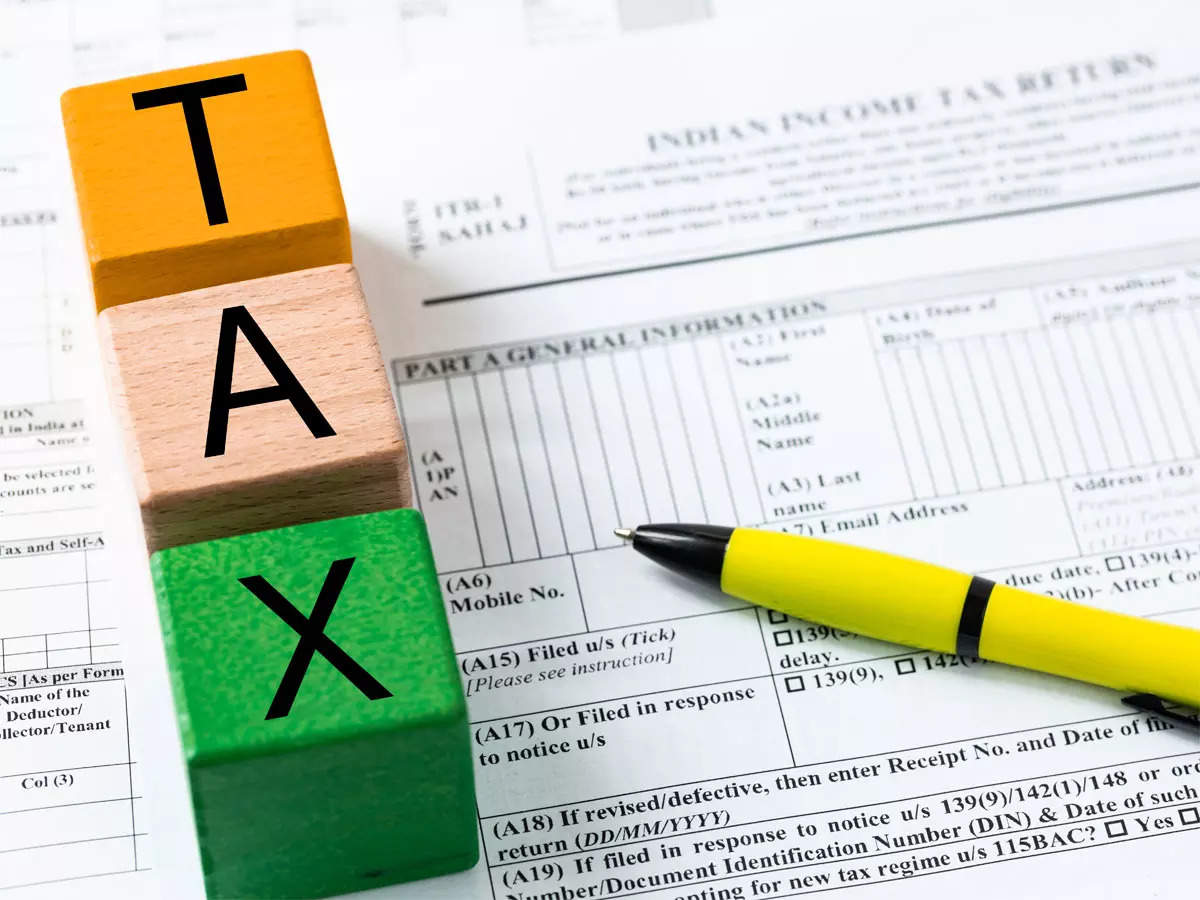

Using the incorrect ITR form is one of the most frequent mistakes made while filing an Income Tax Return. ITRs come in a variety of formats. You should use the appropriate ITR form to file the return in this circumstance.

Failing to have your bank account pre-verified

Pre-verifying the bank account is crucial when completing income tax returns, particularly if the taxpayer anticipates receiving a tax refund for any excess tax paid. The Income Tax Department won’t be able to credit your overdue income tax refund if you don’t do this.

Read more: The stylish smartphone from Nokia arrived to destroy the pride of Chinese phones!

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |