The deadline for filing ITR is approaching. The deadline for submitting an individual income tax return has been established for July 31, 2023. Additionally, by this date, the financial year 2022–2023’s income must be disclosed. On the other hand, according to the Income Tax Department, more than three crore tax returns have been submitted thus far. In addition to this, the Income Tax Department has also made a particular announcement that the public has to be aware of.

Financial statement

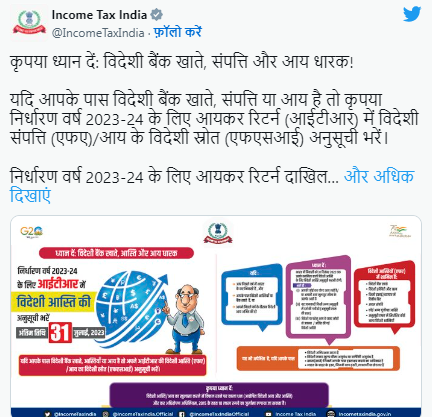

In reality, people are required to disclose their income when completing their tax returns. Giving specifics about how people earned money over the fiscal year is highly significant. Additionally, the Income Tax Department has advised that holders of overseas property, bank accounts, and income take care of essential matters as well. Foreign bank accounts, property, and income holders!, the Foreign Income Tax Department tweeted. Please complete the Foreign Assets (FA)/Foreign Source of Income (FSI) schedule in your Income Tax Return (ITR) for Assessment Year 2023–24 if you have foreign bank accounts, assets, or income. For the assessment year 2023–2024, the deadline to file an income tax return is July 31, 2023.

Illicit funds

On the other hand, the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, states that if someone fails to provide such information, a punishment of Rs. 10 lakh may be imposed. If you were an Indian resident in the preceding year, have foreign assets or bank accounts, or received foreign income during that time, you must disclose this information in your ITR.

Foreign resources

Keep in mind that the resident of India must complete the foreign asset schedule for any foreign assets that he owns as of December 31, 2022. even if your income is below the basic exemption limit or you have no taxable income. Whether or not this information is included on any other schedules (like Schedule AL), foreign assets acquired from stated foreign or domestic sources of income.

Foreign bank accounts are included in foreign assets (FA).

- Foreign debt and equity

- Immovable property, any other capital asset

- Any other foreign assets included in Schedule FA.

- Financial involvement in any entity or business.

Read More: OMG! Sales of this affordable SUV rose by 140%, leaving Scorpio behind

| |

YouTube YouTube | Click Here |

Facebook Page Facebook Page | Click Here |

Instagram Instagram | Click Here |

Telegram Channel Telegram Channel | Click Here |