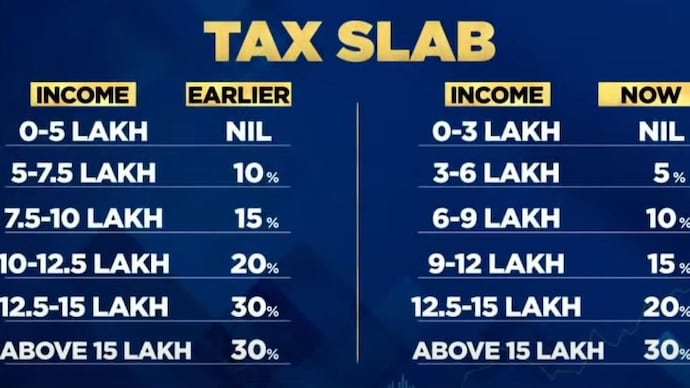

For thousands of taxpayers, good news began to arrive even before July 31. You will now owe no tax if you haven’t submitted your ITR yet. Yes, you won’t have to worry about paying a lot of income tax any longer. Your income won’t be subject to any taxes going forward. About this, the Finance Minister himself has made an announcement. In this budget, Nirmala Sitharaman announced a number of significant tax-related measures. Here are some tips for avoiding paying taxes.

Tax Laws Changed

Many tax-related rules were altered as a result of the start of the new fiscal year in April. If you take advantage of the new tax system, you will now not only profit from more exemptions but also from freedom from paying taxes. The new tax system has rendered income up to Rs 7 lakh tax-free, meaning that if you make Rs 7 lakh per year, you do not have to pay any taxes.

Will benefit from the standard deduction

Nirmala Sitharaman, the finance minister, also made another significant disclosure in the Budget 2023. Prior to the current tax system, taxpayers did not benefit from the standard deduction. However, Nirmala Sitharaman declared during the presentation of the Budget 2023 that from now, even under the new tax system, salaried and retirees will benefit from the basic deduction of Rs 50,000.

Additionally, in the financial year 2023–24

if your yearly income is Rs 7 lakhs and you pick the new tax regime, you would not be required to pay any tax since under the new tax regime, Section 87A of the Income Tax Act will not apply. This means that income up to Rs. This now offers a tax exemption worth Rs 25,000 instead of Rs 12,500. For non-government employees, the exemption from leave encashment has risen and is now exempt up to a certain amount. Since 2002, this cap has been set at Rs 3 lakh. The current amount is Rs 25 lakh.

Read More: SSC published a recruitment notice for these government jobs!

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |