For the assessment year 2023–2024, millions of people have submitted ITR. When you file your income tax return, you must disclose your earnings. People in this circumstance should also fill out ITR carefully because they may receive notice from the Income Tax Department for a variety of reasons. There is no need to fear if you provided the Income Tax Department with all the correct information while filing your ITR, but if you did not, you risk receiving a warning from the department. Here, we discuss a few reasons why the Income Tax Department may notify you in such a case.

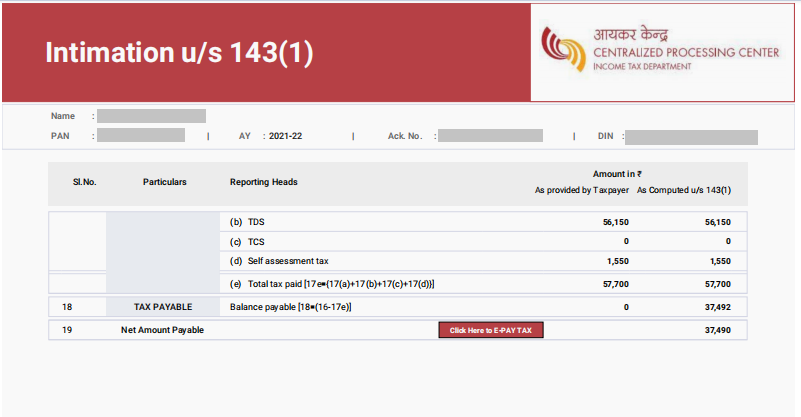

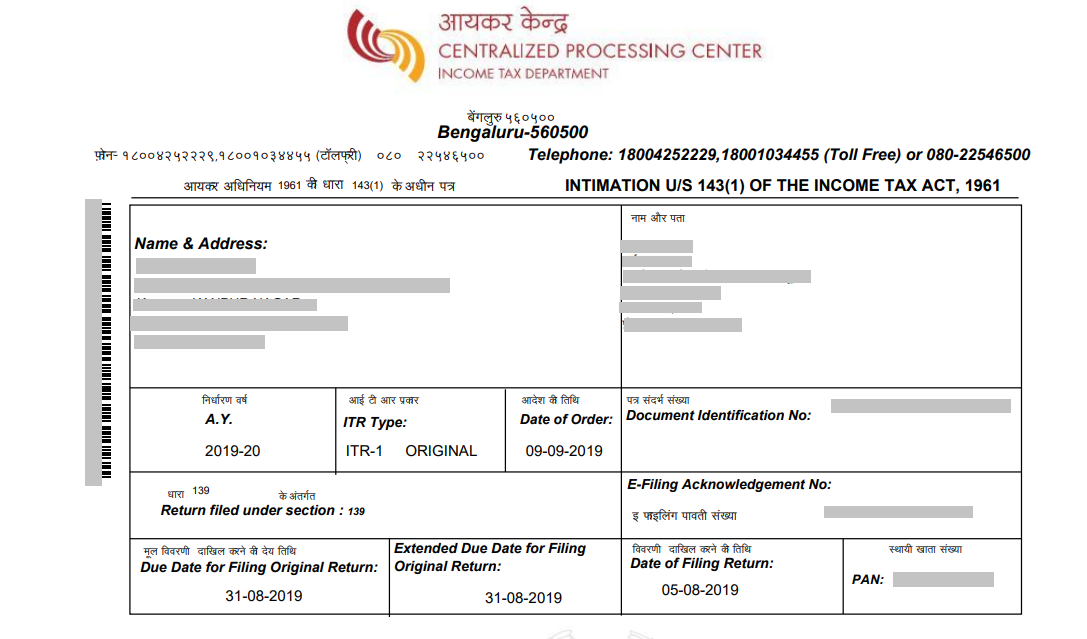

Details required by section 143(1)

A notification under section 143(1) of the Income-tax Act may be given to a taxpayer who has filed his return by sections 139 or 142(1) of the Income-tax Act, accepting either return of income. If any discrepancy is discovered, notice may be given. These include the disallowance of any loss if the taxpayer files a tax return or claims certain specified deductions, any mathematical errors in the tax return, erroneous deductions, exemptions, allowances, etc. by the taxpayer, and a tax audit report (where applicable). Disallowance of expenses reported on Form 26AS or Form 16A/Form 16 but not included in calculating the total income reported on the tax return, and additional revenue reported on those forms but not taken into account.

The section 143(2) notice of ITR

Suppose the Assessing Officer (AO) is satisfied that it is necessary or expedient to demonstrate that the assessee/taxpayer has not understated income, set off an excess loss, or has paid short tax in any way. In that case, they may be given a notice under section 143(2) of the Income-tax Act. The AO may request the taxpayer via such notification to either appear in person at the AO’s office or to present any supporting documentation.

Demand notice under section 156

When the Assessing Officer requests payment of any tax, interest, or penalty, section 156 of the IT Act may allow you to receive a notice. A notice under section 245 of the IT Act may be given to the individual taxpayer and his assessee if a refund is owed to a taxpayer under the terms of the IT Act and that taxpayer also owes back taxes for prior financial years. Unpaid taxes will be subtracted from the refund due. Taxpayers should object to this decision and provide supporting documentation if necessary.

u/s 139(9’s notice for defective ITR

To notify the taxpayer of the error, the Income Tax Department may do so by serving a notice under section 139(9) of the Income Tax Act. According to subject-matter experts. The taxpayer must correct the defect within 15 days (or any extended time limit) of receiving notification. And if the defect is not fixed within the allotted time, the return will be reimbursed. The return will be regarded as invalid.

Section 142(1) notice When a person or organization

has already submitted its income tax return. But is still necessary to provide more information, a notification may be given under this provision. When the Income Tax Department reopens the prior assessment return due to suspected low income, this notice may be sent. Taxpayers have the opportunity to provide clarification in such a notice.

Read More: Announcing the Tecno Pova 5 and 5 Pro in India: Specifications, Features, and More

|

|

YouTube YouTube |

Click Here |

Facebook Page Facebook Page |

Click Here |

Instagram Instagram |

Click Here |

Telegram Channel Telegram Channel |

Click Here |